Terra, the fast-growing DeFi tool kit built on Cosmos, is now officially the second-largest ecosystem in decentralized finance after the latest rise in the price of LUNA, Terra’s native token.

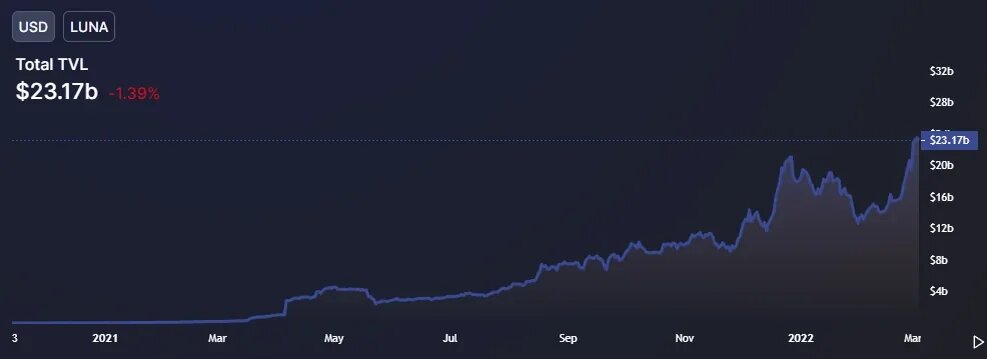

According to DeFi Llama, Terra currently boasts total value locked (TVL) of over $23 billion, marking an all-time high in US dollar terms.

This is roughly twice as much as BNB Chain (formerly Binance Smart Chain) and Fantom. Ethereum still dominates 54% of the entire DeFi market, commanding $111 billion.

(Source: DeFi Llama )

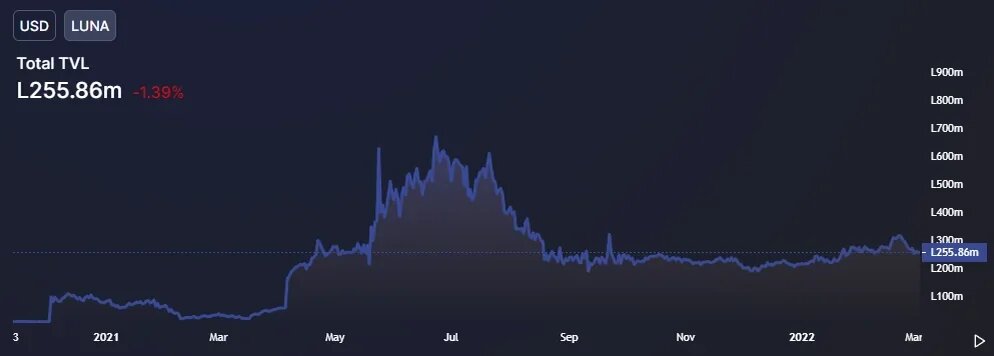

But if we switch our chart over to TVL expressed in LUNA, the Terra network’s native token used to pay transaction fees and vote on governance, the picture’s a bit different.

Instead, the recent spike looks more like a minor blip compared to activity last summer.

(Source: DeFi Llama )

This indicates that alongside an uptick in actual activity (folks pouring crypto into the network to do fun DeFi things), the primary motor for the network has been the mooning price of LUNA.

CoinGecko shows that LUNA has risen by nearly 38.8% over the past week. Over the same period, the native token behind Terra’s largest DeFi project, Anchor Protocol (ANC), also soared by more than 70%. Anchor is a money market akin to Ethereum’s Aave, where users can earn up to 19.49% on their UST (Terra’s algorithmic, USD-pegged stablecoin).

So, there’s lots of price action giving the Terra ecosystem a hefty boost. The reasons for the latest boost are myriad. The LUNA token, for instance, just began trading on FTX Exchange last month.

More important, though, was the protocol earmarking $1 billion for a Bitcoin treasury, generated through a LUNA token sale. Jump Crypto and Three Arrows Capital led the raise on February 23, with the funds reportedly being used to establish something called a “UST Forex Reserve.”

The idea is that Luna Foundation Guard (LFG), a nonprofit organization designed to support all things Terra, will be able to provide the stablecoin with a non-correlated reserve in case of any volatile price swings. This will help keep UST pegged to $1.

The fact that this reserve is in a non-correlated reserve is important given the design of UST and LUNA. Each time $1 of UST is created, $1 in LUNA is destroyed. The inverse is also true—each time LUNA is created, UST is destroyed.

This creates an appealing arbitrage opportunity. If UST falls below $1, users can still buy that UST and then swap it for $1 of LUNA and pocket the discount. And as this UST is bought then swapped, it’s burned and is removed from circulation. This reduces the stablecoin’s supply and helps lift its price back to $1.

Conversely, as more LUNA is destroyed to mint UST, the circulating supply of LUNA decreases, giving the token a similar boost in price.

As you can see, that’s a very strict supply-and-demand relationship between these two assets. By introducing an unrelated asset like Bitcoin to the equation, the LFG is arming itself in case the above mechanism fails to maintain UST’s peg for one reason or another.

And as the market cap of UST gets larger by the week, the $1 billion figure makes a lot of sense. You need a massive reserve to stabilize a project with a market cap of more than $13 billion.

Another advantage of using Bitcoin as a reserve asset for the Terra ecosystem is that it’s censorship-resistant and decentralized rather than, say, the USDC stablecoin that backs the algorithmic stablecoin DAI.

And though it’s still a long way from catching Ethereum, Terra pulled away from the rest of the DeFi pack.

The Terra blockchain launched in January 2018 and uses fiat-pegged stablecoins to run its payments system. Its native LUNA token is then used to stabilize the price of the protocol’s algorithmically-backed TerraUSD stablecoin, UST. In addition, according to its whitepaper, LUNA holders can submit and vote on governance proposals of their own.