The fintech industry has evolved from early adopters using technology to automate financial services to a comprehensive revolution of the financial sector.

The financial technology (fintech) industry has its roots in the late 20th century, with the advent of electronic banking and online stock trading. Since then, fintech has expanded and changed over time as a result of technological and internet advances. As a result, new financial services and products have been created with the intention of enhancing accessibility, simplicity and effectiveness in the financial services industry.

The 2008 global financial crisis aided the growth of fintech by increasing customer demand for non-traditional banking and financial services. By enabling customers to access financial services from any location at any time, the rise of mobile devices and the widespread usage of smartphones have also fueled the growth of the fintech industry. Today, fintech continues to shape the financial industry and is driving innovation in areas such as payments, lending, investing and insurance.

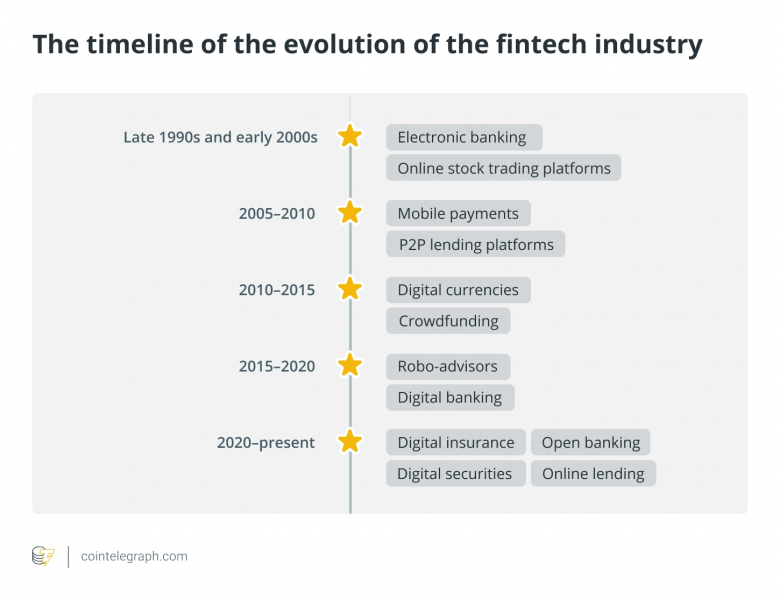

The evolution of the fintech industry

The fintech industry as we know it today did not exist before the late 1990s and early 2000s. Nonetheless, fintech’s origins can be traced back to the advent of computer systems and the growth of electronic banking in the financial services industry in the 1970s and 1980s. These early innovations set the stage for fintech’s expansion and development in the latter half of the 20th century and beyond.

The evolution of the fintech industry has been rapid and dynamic, with significant changes taking place year after year.

Late 1990s and early 2000s

Early adopters of the fintech sector offered fundamental financial services such as online stock trading and electronic banking when the sector was still in its infancy. The following are some instances of fintech products and businesses that appeared in the late 1990s and early 2000s:

- Online stock trading platforms: Customers were able to trade stocks online for the first time thanks to businesses like E-Trade and Charles Schwab, dramatically enhancing accessibility and convenience in the stock market.

- Electronic banking: Wells Fargo and Citibank, among other financial institutions, provided online banking services that let clients monitor their accounts and conduct financial transactions.

Additionally, payment processors, such as PayPal, emerged as early players in the payments space, providing consumers with a convenient and secure way to send and receive money online.

2005–2010

New products and services were created in industries, including payments, loans and insurance as a result of the growth of new fintech businesses. The expansion of fintech was also fueled by the growing use of smartphones during this period. Two examples of fintech products or businesses that appeared between 2005 and 2010 are:

- P2P lending platforms: Lending Club, one of the earliest peer-to-peer (P2P) lending platforms, was established in 2006 and connects investors and borrowers without the need for traditional institutions.

- Mobile payments: In 2009, Square, a company specializing in payments on the go, created a system that enables small companies to accept credit cards via a mobile device. This was a significant advancement in the payments industry that aided in the development of mobile payments.

2010–2015

Following the financial crisis of 2008, the emergence of alternative finance gave fintech businesses new prospects in sectors such as crowdfunding and peer-to-peer lending. Blockchain technology’s emergence has also started to show promise as a potential disruptor in the financial services industry.

The fintech products or companies that emerged during 2010–2015 are:

- Crowdfunding: Kickstarter, founded in 2009, became one of the first crowdfunding platforms, allowing entrepreneurs and creators to raise funds for their projects from a large number of supporters.

- Digital currencies: Bitcoin, created in 2008, was the first decentralized digital currency and marked the beginning of the rise of cryptocurrencies. Bitcoin and other digital currencies provided a new way for consumers to store and transfer value, disrupting traditional finance.

2015–2020

Fintech products and services have been widely adopted, leading to further consolidation in the sector as it continues to develop and flourish. To introduce new financial services to the market, traditional financial institutions started to enter the market and collaborate with fintech firms. The emergence of digital assets like cryptocurrency gave the market a fresh perspective.

Two examples of fintech products or companies that emerged during 2015–2020 are:

- Robo-advisers: Betterment and Wealthfront, founded in 2008 and 2011, respectively, became two of the leading robo-advisers, using algorithms and automation to provide personalized investment advice and manage portfolios for individual investors.

- Digital banking: Challenger banks such as Monzo, N26 and Revolut, founded in 2015, 2015 and 2013, respectively, offered digital-only banking services, providing consumers with alternative banking options and a more modern and convenient banking experience.

2020–present

Due to the COVID-19 epidemic, many customers are now using digital financial services for the first time, which has accelerated the expansion of fintech. New technologies like artificial intelligence (AI) and machine learning are being used to enhance financial services as the sector continues to develop and innovate. The regulatory landscape is likewise evolving to reflect the development and maturity of the fintech sector.

Some examples of fintech products or companies that have emerged after 2020 include:

- Digital insurance: Lemonade, founded in 2015, became one of the leading “insurtech” companies offering a digital platform for purchasing home and renters insurance.

- Digital securities: Companies such as Coinbase, Bakkt and Paxos, founded in 2012, 2018 and 2012, respectively, have emerged as leaders in the digital securities space, providing platforms for buying, selling and holding digital assets, such as cryptocurrencies and security tokens.

- Open banking: Companies like Plaid, founded in 2013, and Yapily, founded in 2016, have emerged as leaders in the open banking space, providing APIs and infrastructure for secure access to financial data and enabling innovation in the fintech industry.

- Online lending: Affirm, founded in 2012, and Afterpay, founded in 2014, provide consumers with a range of credit options for online purchases.

The future of the fintech industry

The future of fintech is expected to continue its rapid growth as technology continues to shape and revolutionize the financial industry. Financial services will become more accessible, secure and innovative thanks to innovations like blockchain, AI and open banking.

In addition, there will be a trend toward digitization as more and more customers choose mobile and online banking options. It can be anticipated that traditional financial institutions and fintech firms will increasingly integrate, which will result in the development of new financial services and products.