One of the earliest signs that things were going wrong for Terra came when UST deposits on Anchor started dropping Saturday – Sam Kessler and Sage D. Young analyzing on CoinDesk.

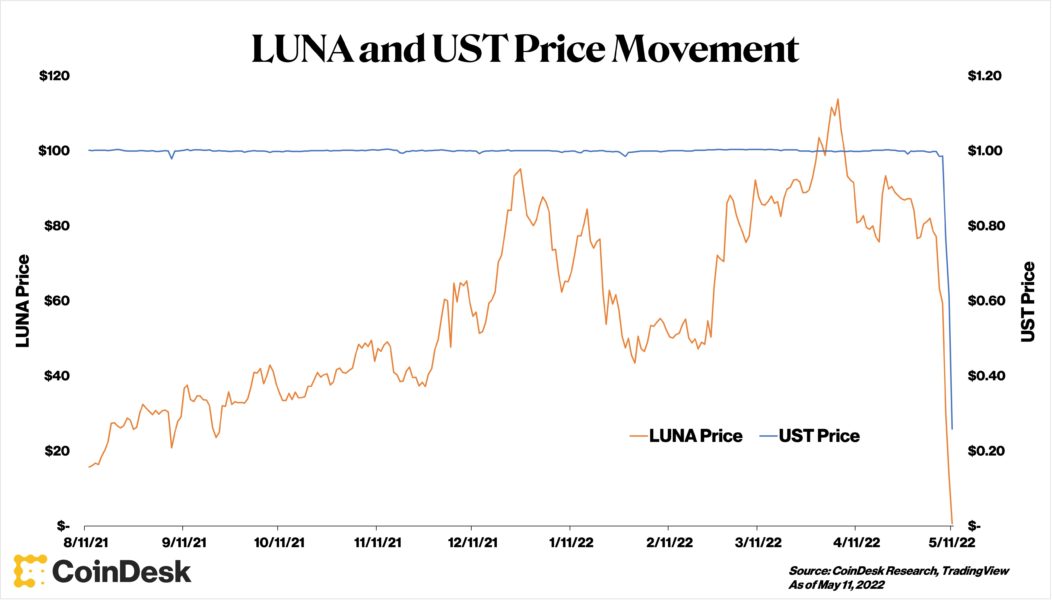

The Terra money machine collapsed almost entirely Wednesday. The UST stablecoin remains deep in the sub-dollar doldrums for the third day running, and LUNA, its sister token, has fallen almost 97% off its 2022 high. The near-complete failure of a darling of decetralized finance (DeFi) stands as an important lesson in the systemic risks of algorithmic stablecoins – crypto’s elusive Holy Grail.

Understanding why UST collapsed this past week means understanding its Achilles heel – the Anchor lending protocol.

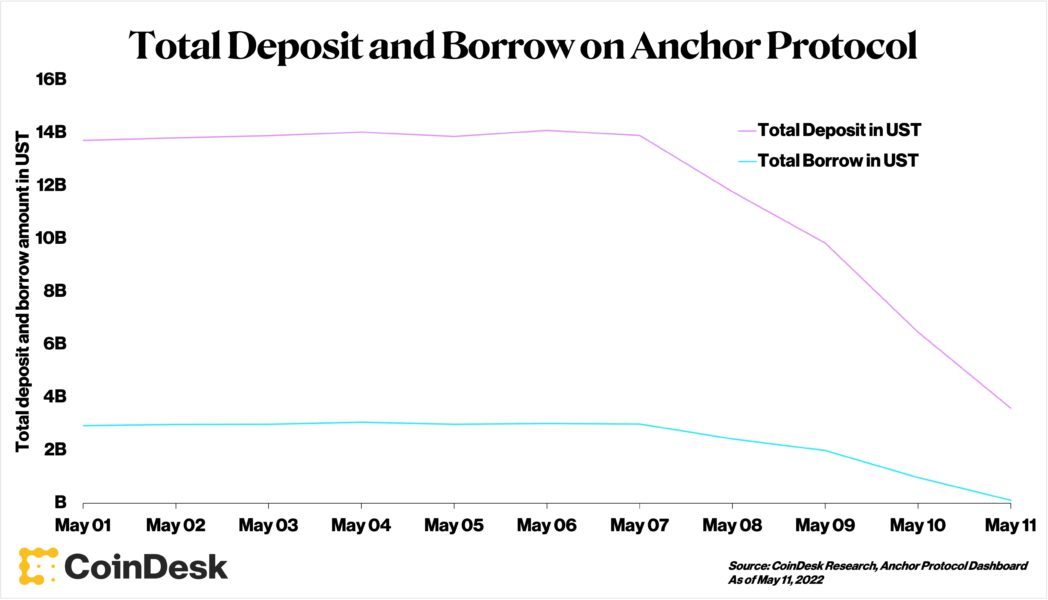

One of the earliest signs that things were going wrong for the stablecoin came when UST deposits on Anchor started dropping Saturday.

Anchor offers market leading yields of up to 20% on the year to users who deposit their UST on the platform. Before UST started its decline late on Saturday, Anchor was home to 75% of UST’s entire circulating supply. That’s $14 billion of UST out of a total circulating supply of $18 billion.

With so much UST locked up in Anchor, it became clear that most investors were buying the stablecoin with the sole intent of reaping those sweet, sweet Anchor yields. Depending on whom you ask, Anchor’s relationship with UST was either an ingenious mechanism to manufacture utility for the fledgling stablecoin, or wasteful marketing spend attracting unloyal mercenary capital.

Critics said Anchor’s high yields were unsustainable – artificially propped up by Terra builders Terraform Labs (TFL) and its big money backers. A yield decrease, they say, would’ve sent UST depositors fleeing Anchor (and UST) in search of higher returns.

The system looked similar to that of a young Uber, where venture capitalists subsidized peoples’ ride fees in a long-term bid to achieve market dominance. Instead of cheaper cab fares, inflated Anchor yields were used to pull people into the UST ecosystem – hopefully permanently. The problem, according to critics, was that TFL and its partners could only afford to subsidize investors for so long. At some point, the money would dry up, and so would Anchor’s customers (and UST’s willing holders).

Though Anchor was never forced to decrease its yield rates too significantly, UST deposits dropped sharply through the start of this week, from $14 billion to as low as $3 billion. So much money draining from UST’s primary hub signaled a massive loss in confidence in the entire Terra protocol. With few other use cases for UST beyond Anchor, most withdrawals from the platform probably ended up on the open market.

As one might expect, the massive drain from Anchor onto the open market contributed major selling pressure to the Terra ecosystem.

UST, a so-called algorithmic stablecoin, works with its sister token, LUNA, to maintain a price around $1 using a set of on-chain mint-and-burn mechanics. In theory, these mechanics are supposed to ensure $1 worth of UST can be used to mint $1 of LUNA – which serves as a sort of floating price shock absorber for UST volatility.

The massive selling pressure led to sharp drops in the prices of both LUNA and of UST. Eventually, the market cap of LUNA flipped that of UST for the first time. When there was no longer $1 worth of LUNA for every $1 of UST, some watchful traders feared the entire system might become insolvent (because UST holders would have no clear way to “cash out” into LUNA in the event of a full-scale bank run). Whether this fear was fair or not (we’ll talk in the next section about LUNA’s bitcoin backstop), it’s hard to imagine that the psychological impact of nose-diving prices and a UST-LUNA market cap “flippening” didn’t cause even further sell action.

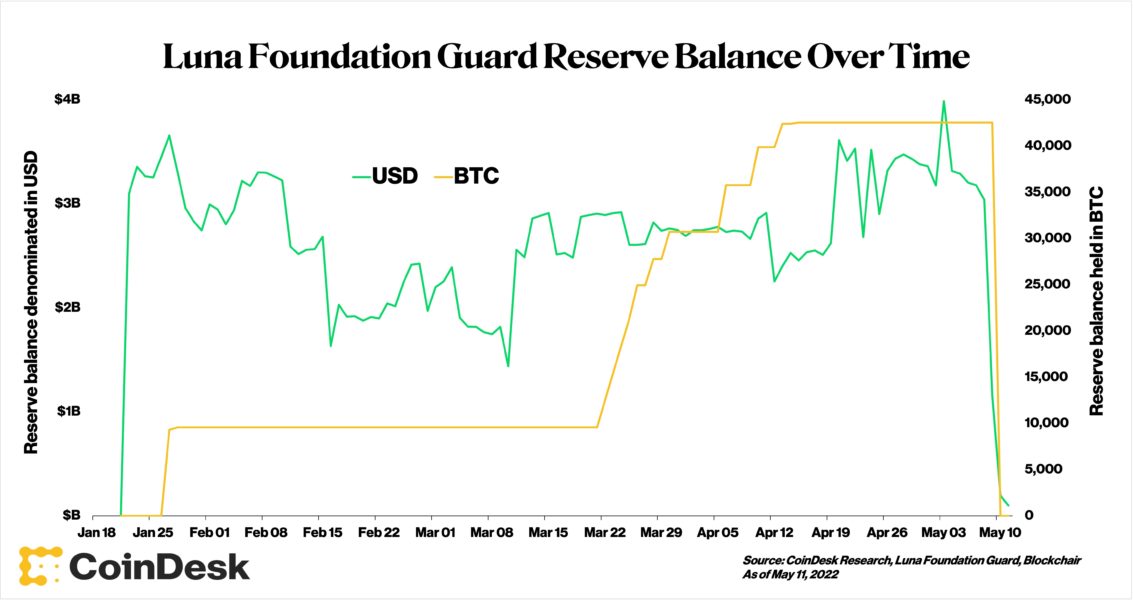

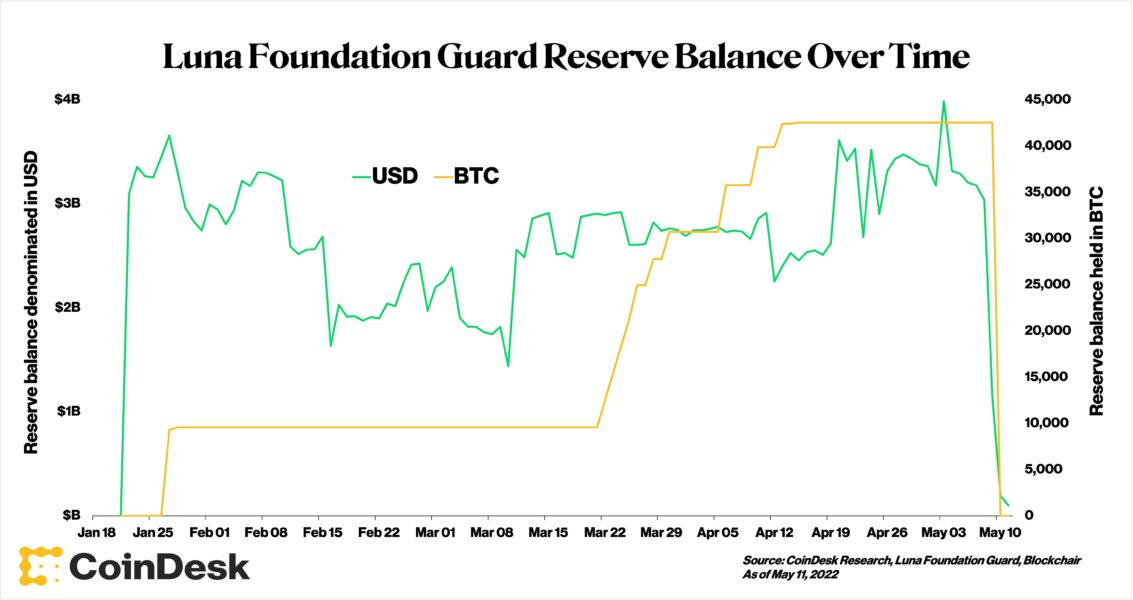

In order to shore up UST’s price, the Luna Foundation Guard (LFG), Terra’s official peg defenders, deployed over $2 billion in its newly formed bitcoin (BTC) reserves.

Do Kwon started sweeping BTC off the market in recent months in an attempt to backstop UST, should its peg ever need defending.

In its first (and perhaps final) test of this mechanism, LFG “loaned” billions of dollars worth of reserve assets to professional market makers, draining LFG’s blockchain wallets almost entirely in the process.

Now, as LFG struggles to top up its empty reserves with new investors, market makers are on a quest to actively defend UST’s peg by deploying rescue capital on exchanges and liquidity pools.

While the rescue capital from Terra’s reserves had modest success bumping up the prices of UST and LUNA on Tuesday, the prices of both were extremely volatile leading into the early morning hours of Wednesday.

It was at this point that all bets seemed to be off for a smooth UST recovery. Even as Do Kwon announced on Twitter a UST rescue plan was in the works, market confidence in the project appeared to fall to all-time lows. At one point, LUNA – priced at over $120 earlier this year – fell below $1. UST fell below 30 cents for a brief time, leading to questions around whether the “stable” coin will ever be able regain its stability.

Much of the hundreds of millions of dollars in bitcoin used to rescue UST were likely sold straight to market early this week. Cash-outs to non-BTC currencies would have been necessary for traders hoping to defend UST’s peg.

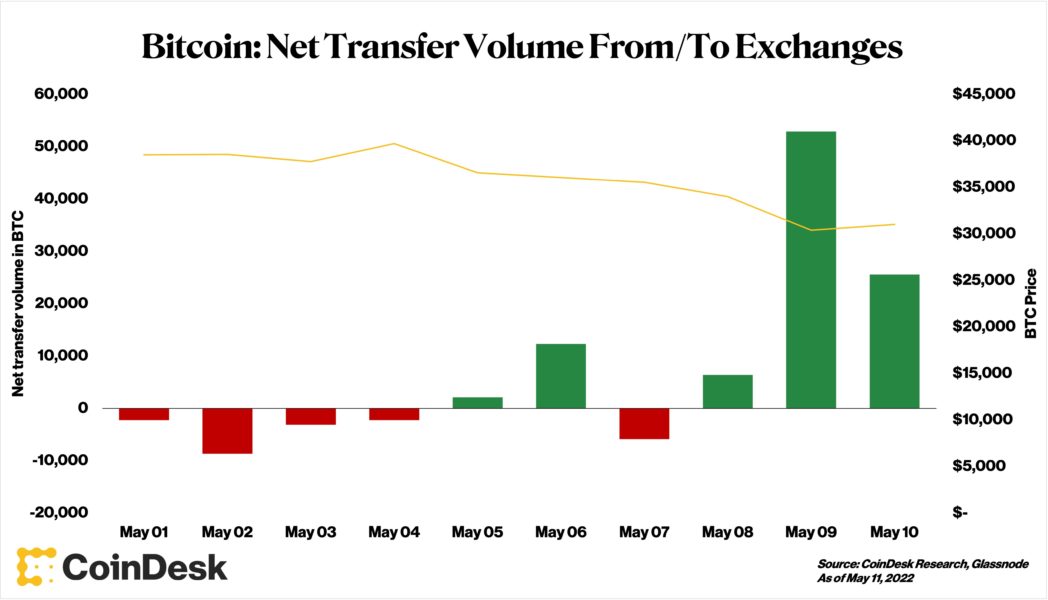

Charts of BTC net transfer volumes tell this story, showing massive volume spikes on May 9-10 as Terra’s reserves were first deployed. While Terra doesn’t account for the entirety of these spikes, billions of dollars in freed-up Terra reserves would certainly have made an impact.

Terra’s BTC reserve dumps probably added sell-pressure to an already tumultuous market.

The impact of UST on the wider market is an important footnote amid all of this week’s chaos. It stands as a reminder of why stablecoins – which form the foundation of decentralized finance – not only pose a risk to individual traders, but pose a systemic risk for the entire crypto ecosystem if not managed responsibly.

Don’t be surprised when the regulators come knocking.

Pics source: https://www.coindesk.com/layer2/2022/05/11/the-luna-and-ust-crash-explained-in-5-charts/