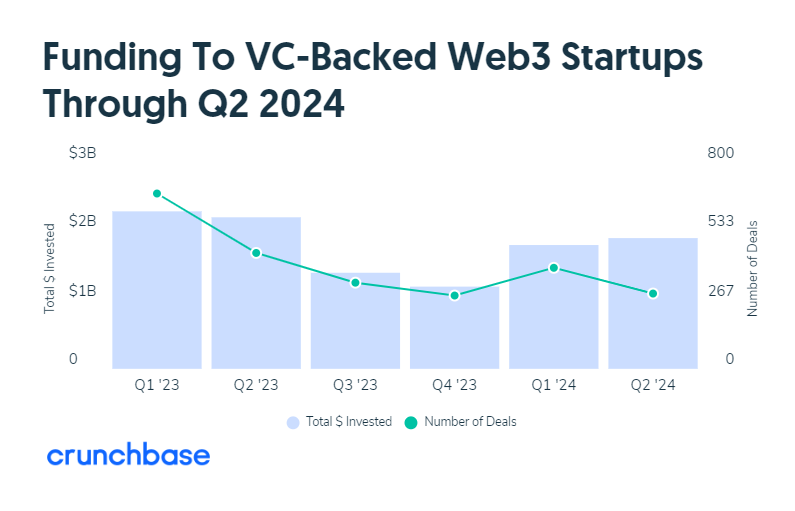

Venture funding for Web3 startups is stabilizing after a year-long decline that started in 2023, with crypto ventures locking up some $2 billion in financing in the second quarter of 2024, according to Crunchbase.

The Q2 numbers are only modestly higher than the $1.8 billion raised in the prior quarter but reverse a downtrend that saw Web3’s quarterly venture funding totals drop by roughly half last year, from $2.3 billion in Q1 of 2023 to $1.4 billion in Q4, according to Crunchbase.

A drop in the total volume of deals mirrored the decline in funding. Total deal volume fell from a peak of 681 in Q1 of 2023 to some 284 in Q4. Despite the most recent quarter’s rebound in funding amounts, deal volume continues to languish, with only 291 financing rounds closing in Q2 of 2024, according to the data.

Not only are Web3 venture deals still scarce, but they are also more cautiously sized. In Q2 2024, only seven rounds exceeded $50 million, Crunchbase said.

In fact, much of this past quarter’s apparent recovery is attributable to one deal: New York-based Monad Labs’ $225-million funding round led by Paradigm. Monad is a new layer-1 blockchain network set to compete with Solana, among others.

Other notable Q2 deals include Farcaster’s $150-million Series A led by Paradigm, valuing the company at $1 billion; Berachain’s $100-million round led by BH Digital and Framework Ventures, valuing it at $1.5 billion; and Auradine’s $80-million round from investors, including Mayfield Fund and Celesta Capital, Crunchbase said.

The sluggish deal flow is partly because venture fund investors — known as limited partners (LPs) — are waiting on payouts from past deals before financing new ones, and venture capital firms (VCs) are beginning to run low on dry powder, according to Regan Bozman, co-founder of venture firm Lattice Capital.

“There is a market dislocation starting to happen where many crypto VC funds are on the final 25% of deployment and so will need more money in next six months, but LP’s want distributions first,” Bozman said in a post on the X platform. “But VCs need the market to come back before they can make distributions.”

Source: https://cointelegraph.com/news/web3-venture-funding-stabilizes-after-rocky-2023-crunchbase