What are LP tokens?

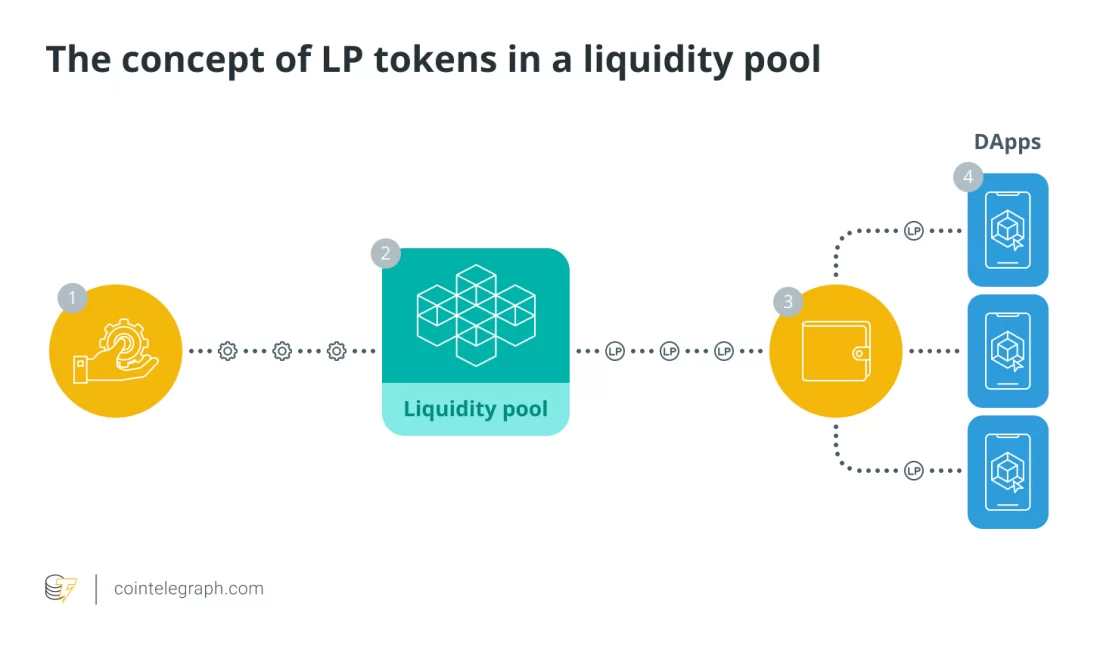

Liquidity providers deposit assets into a pool to facilitate trades on decentralized exchanges (DEXs) and automated market makers (AMMs) and receive liquidity pool tokens (LP) in return.

Liquidity pool tokens are also called liquidity provider tokens. They act as a receipt for the liquidity provider, who will use them to claim their original stake and interest earned. These tokens represent one’s share of the fees earned by the liquidity pool.

LP tokens have other use cases besides unlocking the provided liquidity. They allow the liquidity provider to access crypto loans, transfer ownership of the staked liquidity, and can earn compound interest in yield farming. Compound interest is interest earned on the original sum deposited. For example, 10% annual interest on $1,000 is $100, while the compound interest in the second year is calculated at $1,100, so it will be $110.

Decentralized exchanges (DEXs) and automated market makers (AMMs) grant their users full custody of their locked assets through LP tokens, and most allow users to withdraw them at any time after redeeming the interest earned.

From a technical standpoint, LP tokens are the same as other blockchain-based tokens. For example, LP tokens issued on DEXs that run on Ethereum will be ERC-20 tokens. Other liquidity provider token examples are the SushiSwap Liquidity Provider (SLP) tokens on SushiSwap and the Balancer Pool Tokens (BPT) on Balancer.