What started with Bitcoin-based colored coins in 2012–2013 became a phenomenon in 2021 and is still thriving. The Ethereum blockchain had a pivotal role in popularizing NFTs.

Though 2021 turned out to be the year of Nonfungible tokens (NFTs), it wasn’t the year when the technology was invented. Kevin McCoy minted the first NFT, “Quantum,” on the Namecoin blockchain in 2014. Nonetheless, the inception of Bitcoin-based colored coins in 2012–2013 marked the beginning of the concept that led to the development of BRC-20 tokens. This idea stemmed from a paper authored by Meni Rosenfield in 2012, and it paved the way for the evolution of digital tokens on the Bitcoin blockchain.

The world, however, noticed NFTs in 2017. This was mainly due to the arrival of the Ethereum blockchain, which overcame the limitations in the blockchains prior to it when it came to hosting NFTs. Ethereum not only provided NFTs with a reliable solution for critical things such as token creation, storage, programming and trading but also lowered the entry barrier for launching NFT projects.

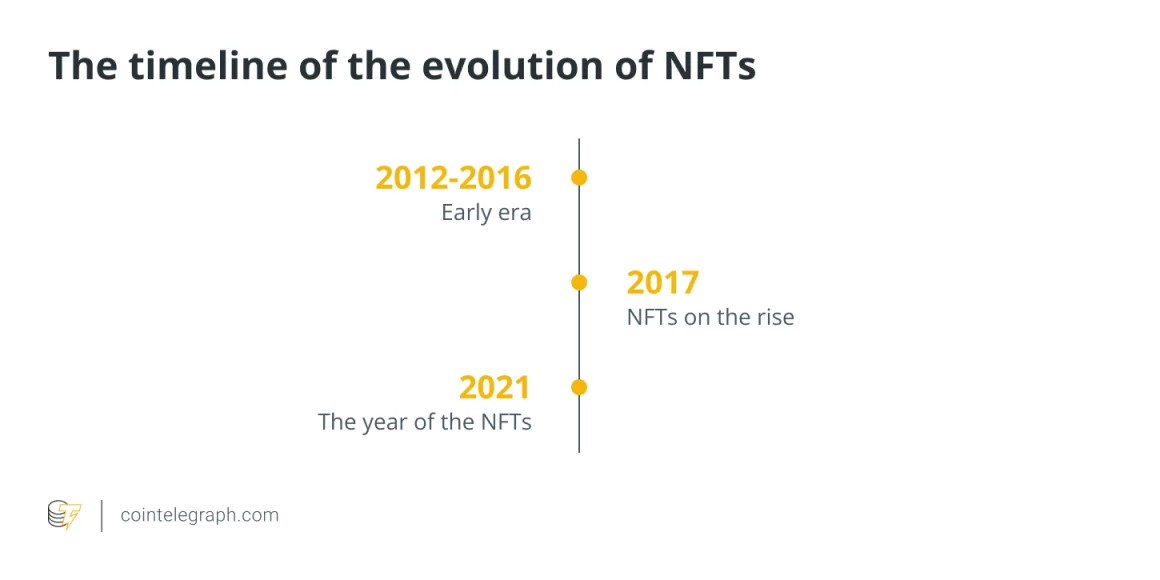

A brief history of NFTs can be segregated into a timeline:

The evolution of NFTs: From colored coins to the emergence of Rare Pepes and Spells of Genesis

As mentioned, the story took off with colored coins, which were created to represent and manage ownership of real-world assets on the blockchain. They were different from Bitcoin (BTC) because of the “nonfungible” element that provided them with a unique utility.

Demonstrating a humongous leap in Bitcoin’s capabilities, colored coins were composed of tiny fractions of a Bitcoin, which could be as minuscule as a satoshi. Use cases of colored coins, such as the representation of property, coupons, or usage as digital collectibles, subscriptions, shares and access tokens, helped people realize the potential of blockchains for issuing assets.

Bitcoin, however, was never intended to be used as a database for tokens, which meant that colored coins just remained at the concept level. However, the development did set off a series of experiments that culminated in NFTs. The first of the NFTs was “Quantum,” as mentioned before, an octagon-shaped animation. The arrival of Ethereum provided NFTs with the platform they required to flourish.

A major project of this period that enabled the development of digital assets was The Counterparty platform built on Bitcoin. A spectrum of “Rare Pepes” NFTs was released on The Counterparty, initiating the use case of NFT as artwork. “Spells of Genesis,” created on Ethereum, was another big NFT project after The Counterparty.

The rise of NFTs in gaming and the metaverse: From CryptoPunks to Axie Infinity

Ethereum introducing a set of token standards facilitated the steady movement of NFTs toward the blockchain. The token standard informs developers how to deploy new tokens.

The success of the Rare Pepes was followed by Larva Labs, a software development company that launched CryptoPunks, its own generative series of NFTs, created by John Watkinson and Matt Hall. Inspired by London punk culture, the project has 10,000 unique pieces, with no two characters resembling each other. CryptoPunks became a huge success and was the foundation of many other NFT projects, including the Bored Ape Yacht Club, one of the biggest NFT collections.

The next major launch was CryptoKitties, which came up during the ETHWaterloo hackathon, back in October 2017. The game enables players to buy, sell and create NFTs representing virtual cats with desirable traits on Ethereum. Post CryptoKitties, NFT gaming became increasingly popular.

NFT gaming combined with metaverse projects to formulate a new momentum. A major project of this era was Ethereum-based Decentraland, a virtual world that allows players to explore games and build and collect assets.

In October 2018, Axie Infinity, an NFT-based battle game, was released. It set the ball rolling for play-to-earn (P2E) games, which enabled gamers to earn in-game rewards while playing. It’s a pioneering video game on the Ethereum blockchain involving Axies, creatures that are rare NFTs with unique attributes. Gamers fight battles using Axies and build more attributes into them.

Expanding beyond Ethereum: Non-Ethereum blockchains and the NFT ecosystem

Certain factors propelled NFTs to a sharp surge in 2021. Various blockchains set up new standards specifically for NFTs.

NFTs in 2021 witnessed a spike in supply and demand. According to NFT data company NonFungible.com, NFT trading jumped around 21,000% to top $17 billion during the year.

The usage of NFTs in the art market was a major factor behind the surge. The emergence of digital art provided artists with another venue to showcase their creativity and store their work, which could be verified as well. Thanks to these advantages, digital art gained traction and helped propel the NFT boon.

This was the time when renowned auction houses such as Christie’s and Sotheby’s moved their auctions online. Moreover, these auctions included art that pushed the popularity of NFTs. It was at Christie’s where Beeple’s “Everydays: the First 5000 Days” NFT made a record-shattering sale of $69 million. A sale of that scale drew the attention of non-Ethereum blockchains and blockchain enthusiasts toward NFTs.

Buoyed by the NFT mania, blockchains such as Cardano, Solana, Flow and Tezos started work on their own platforms for NFTs. In September 2021, smart contracts became functional on Cardano, which facilitated the development of NFT applications on the platform. A few new standards were set up by various blockchains to establish the authenticity of nonfungible assets.

A key event of the year was Facebook rebranding itself as Meta and strolling into the metaverse space. NFTs were always an integral part of the metaverse, leading to the surge in demand for NFTs.

Revival and resurgence: NFT market rebounds and issuance of Bitcoin-native NFTs

The sector took a plunge in 2022 but regained an upward trend in 2023, bringing the joy back to NFT aficionados.

For much of 2022, growth in the NFT sector plateaued. Macroeconomic factors brought down the enthusiasm in the NFT market. Even the metaverse had been a talking point before it fell off the radar. Mark Zuckerberg’s metaverse division lost $13.72 billion in 2022.

2023, however, brought smiles back to NFT enthusiasts. Ordinals launched in January 2023, exploiting the 2021 Bitcoin Taproot upgrade, which enabled on-chain Bitcoin-native NFTs. By February 2023, Yuga Labs, the premiere issuer of NFTs in the world, had announced the rollout of “TwelveFold,” a new NFT collection to be issued on the Bitcoin network. Ordinals, an advancement of the concept of colored coins, are serial numbers imprinted in a single, unique satoshi.

As per data from DappRadar, the NFT market clocked $2 billion in total trading volume in February, which was a 117% increase from the previous month. The impetus sustained into March, with data demonstrating only a slight dip to under $2 billion. BCC Research envisions a market value of the NFT sector of $125.60 billion by 2027, with a compound annual growth rate of 27.7% (2022–2027).

Accumulated data from DappRadar and Dune disclosed about 5.8 million total NFTs sold in March compared to approximately 6.5 million NFTs in February. Ethereum NFT trading in February ($1.81 billion) was almost identical in March ($1.82 billion).

Source: https://cointelegraph.com/explained/who-invented-nfts-a-brief-history-of-nonfungible-tokens