Prioritizing the ideas in the Bitcoin white paper instead of perceiving crypto as a forex market could have dramatically changed today’s cryptocurrency use cases.

Ignoring the original, utility-driven ideas introduced in the early documents on digital cash became the new normal once adopters stumbled upon a cryptocurrency price ticker. Are new price tickers a sign of innovation?

There is a critical paradox when thinking about inventions and new things. Culture influences technology, while the technology itself influences culture. This also applies to distributed ledger technology (DLT). However, the case of cryptocurrency is more curious than other innovations because it is not currently used in the way the inventor initially proposed.

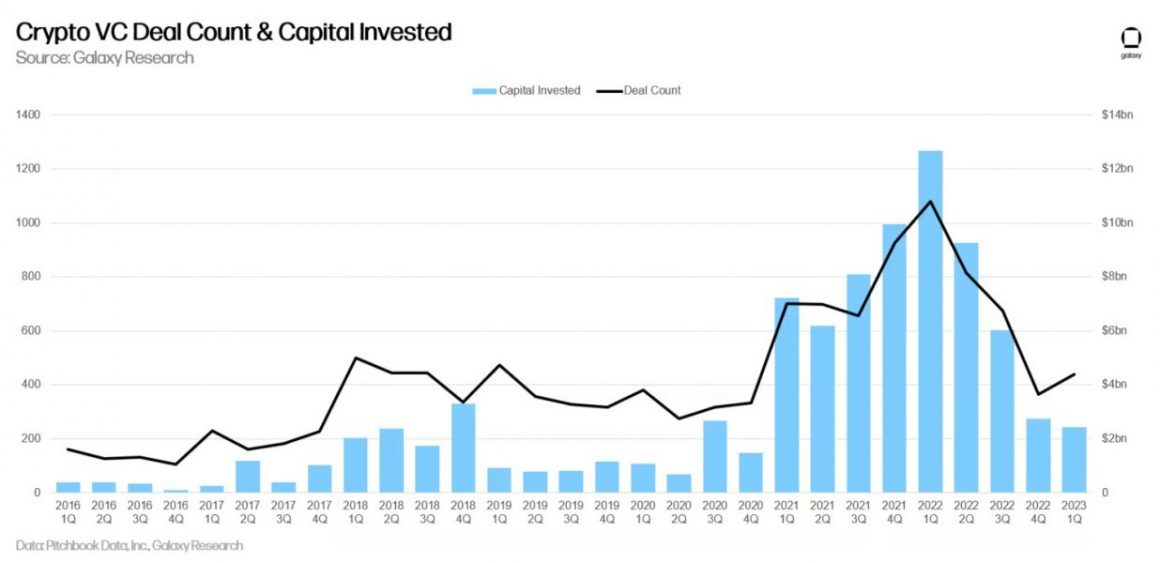

Some might argue that the way cryptocurrencies are currently interpreted — primarily as investments rather than transactional units for the most part — is more harmful than beneficial. Smart money helps drive these possibly malicious use cases of crypto, and the main question is — why is that?

Smart money

Smart money refers to financial organizations or individuals with significant resources, expertise and capital. More specifically, the money that flows in and out of central banks, funds, venture firms, or even the wallets of individual investors is smart money.

This type of capital is essential for discussions of new technologies, regardless of the industry or surrounding markets, and the phenomenon appears in various economic landscapes — everything from JP Morgan financing Thomas Edison’s inventions to venture firms driving the internet startup equity bubble from 1995 to 2000.

There are other issues that inventors and builders face when there is a lot of investor involvement, but the main concern comes from smart money utility being a limiting factor and the lack of discourse around this in the DLT space.

Common economic flaws persist in crypto markets

The problem of crypto adoption may not be as bad as it seems, as only small, tightly-knit communities are working on more attractive use cases and paths to mainstream crypto adoption.

This can force the creation of counterproductive markets where retail and institutional investors presume intrinsic value from either scarcity or thin air, and the utilitarian side of novel systems is only seen by underdog pioneers who don’t have much leverage at the time. Although blockchain technology operates in a decentralized manner through peer-to-peer node interactions, even in the early days of crypto, when the whales were just appearing, potential problems such as concentration of wealth and purchasable network control began to emerge.

Additionally, the nature of cryptocurrency ecosystems, token design, their relation to fiat currency and the lack of regulation made market manipulation easier and more attractive to indulge in for malicious actors. The zero-regulation part was as appealing to institutions as it was to retail traders or criminals.

Wall Street Journal reported that groups of online traders who gather on messaging servers to collaborate on pump-and-dump schemes have manipulated nearly $1 billion in 2018 alone, which would be much harder to achieve in a traditional market.

Why was Bitcoin invented in the first place?

Concerning crypto use cases, the token-as-an-investment feature has become so mainstream that, collectively, we hardly ever think about Bitcoin and its alternatives as digital cash or tools for probing decentralized systems to advance our everyday lives.

The global financial crisis of 2008 and some other periods in our economic history were mostly caused by influential people in the financial world whose aims did not necessarily relate to those of the average market participant. The idea of decentralization has been considered a potential solution to the problem of market control and influence. However, as discussed, today’s DLT designs still cannot protect the markets around them from manipulation.

The crucial part, however, is that technology like blockchains doesn’t stagnate because of the ever-increasing involvement of smart money, which continues to push the idea that crypto works best as an investment, usually because of limited supply or just plain virality.

Ignorant growth of mainstream adoption

Although smart money brings crypto into the public eye by investing in tokens or startups, bringing more mainstream attention to the space, the downside is that newly minted crypto enthusiasts enter the space with a crypto-as-an-investment mindset.

They may then introduce crypto to their friends as a “buying opportunity” while having their financial interests in the matter. This can create a cycle that vaguely resembles a horrid pyramid scheme, MLM or pump-and-dump itself without the participants realizing it.

If early crypto adopters had focused on implementing the ideas explored in the now-famous Bitcoin white paper instead of seeing crypto as a forex market, today’s cryptocurrency use cases could look very different.

An ironic part of blockchain history is that while criminals “pioneered” real digital cash transactions on the dark web, the rest of the world traded, kept buying or simply forgot about cryptocurrencies until they became big.

Final thoughts

It is hard to say if there is a solution to this cryptocurrency abuse. It would be difficult to effectively encourage institutions to pay attention to startups building DLT systems for real-world, scalable use — just as it‘s difficult to convince traditional organizations or governments to adopt crypto without promising a financial return.

However, the aforementioned underdog inventors and builders who, in recent years, have been working on things like decentralized file storage, off- and on-chain data and transaction scaling should be enormously appreciated, acknowledged and introduced to smart money as often as possible. Such a prescription might just help users shake off the idea that crypto can be little more than an investment.