Developers are flocking to the platform’s blockchain, but nimbler rivals are emerging, Richard Waters writes on FT.

Is Ethereum the future of the internet?

Interest in the Ethereum blockchain has soared over the past year, as developers have turned to it to create a wave of decentralized finance projects, known as DeFi, and unique digital tokens called NFTs.

The rise of new applications like these — among the first running on a public blockchain — have already created what supporters claim is a powerful network effect, as increasing activity brings more and more developers to Ethereum. That could make it the platform of choice for what has become known as Web 3.0, where a series of decentralized apps could one day challenge Big Tech’s offerings.

“Sixty to 70 per cent of the industry runs on Ethereum. It’s very sticky,” said Sandeep Nailwal, co-founder of Polygon, one of a growing number of companies that operate on top of Ethereum.

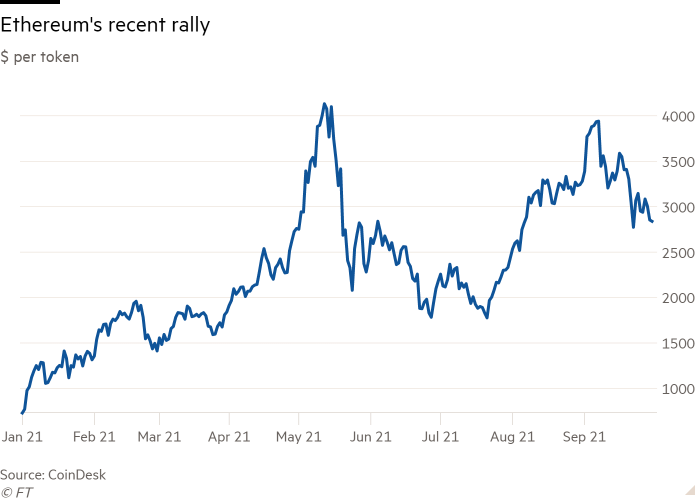

As a result, the price of Ethereum’s currency, known as Ether or ETH, which is used to pay for the computing power needed to run the blockchain, has jumped ninefold. At around $350bn, the outstanding tokens on Ethereum are now worth more than 40 per cent as much as all the Bitcoin in issue, more than double the proportion of a year ago.

But there remain fundamental questions over whether Ethereum, which is heavily behind schedule with a complex set of technical upgrades, will be able to compete with nimbler rivals, and whether any consensus will emerge on its long-term role as the crypto world evolves.

“There isn’t a shared narrative in the Ethereum ecosystem,” said Avichal Garg at Electric Capital, an investment firm in San Francisco. “Is it a commodity like oil, digital gold, a better Bitcoin?”

Until the investment world decides on an answer, the price of Ethereum’s tokens, is likely to be volatile, he and others warned.

(Source: https://www.ft.com/content/b1ff8c39-a047-46ac-8df1-650265842c63 )

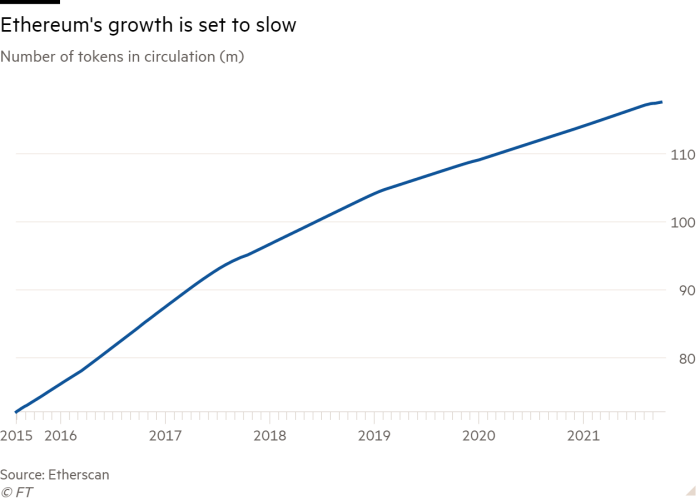

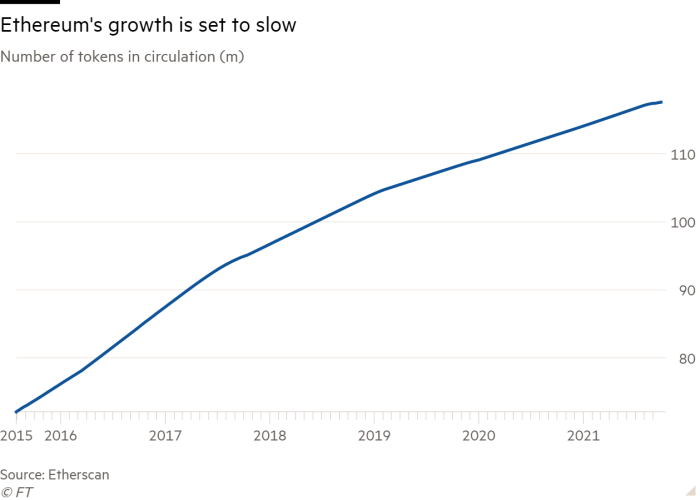

The rally in the price of ETH has been powered by two hopes. One is that Ethereum has entered a new phase in which the number of tokens in circulation will grow far more slowly than it has in the past, or even shrink. For financial speculators, that has raised the possibility that its tokens will become more like Bitcoin.

The supply of tokens has already been reduced following a change last month to the way transactions are validated on the network. Some of the ETH tokens that were previously paid in fees to miners who validate transactions are now destroyed, or “burnt”.

Another big step could come late this year or early next when the blockchain is due to move away from its current “proof of work” system, which relies on miners committing their computing power to the network in exchange for rewards.

Instead, it will be based on “proof of stake”, in which validators participate by lodging some of their ETH holdings. Along with the environmental benefits that come from cutting processing demands, the move has big monetary implications.

(Source: https://www.ft.com/content/b1ff8c39-a047-46ac-8df1-650265842c63 )

A proof-of-stake chain was launched to run in parallel late last year. Some 6% of the supply of ETH has already been lodged there by holders to back transactions, earning holders an annual return of up to 5% — an early sign, according to the bulls, of how much ETH will be taken out of circulation once the full transition is completed.

Until now, ETH has been viewed as the crypto equivalent of oil, said Ninos Mansor at Arrington XRP Capital, a crypto investment firm — a commodity that is consumed to fuel the digital economy but where there is no cap on supply. But a big reduction in supply of the tokens could change that, making it more attractive to investors interested in a deflationary asset, he added.

Unlike Bitcoin, however, Ethereum was not founded on a clear monetary vision or with an upper ceiling to the number of tokens that can be created. Vitalik Buterin, Ethereum’s founder and lead evangelist, has said only that it will adapt to whatever needs its users have for it. That has left open the possibility of further changes in how tokens are created, and hence the long-term supply of ETH, said Mansor.

The second hope behind this year’s price spike is that Ethereum will be a core part of the infrastructure because of its “smart contracts” function, software code that automatically executes when certain conditions are met and which enables peer-to-peer decentralized finance projects, for example.

(Source: https://www.ft.com/content/b1ff8c39-a047-46ac-8df1-650265842c63 )

Yet the network’s capacity is severely limited, and a series of proposals to relieve the pressure is years behind schedule.

The network’s maximum capacity of only around 15 transactions per second has meant that, at busy times, the so-called “gas” fees to use it have been bid up to high levels, squeezing out all but the most high-value transactions. That is one reason that financial applications have come to play a much bigger role on the network this year, according to Buterin.

Meanwhile, newer blockchains with greater processing capacity, including Avalanche, Solana, and Cardano, have sprung up.

“What you’re seeing globally is a rush to scale — and there aren’t that many that are scalable,” said Emin Gün Sirer, founder of Avalanche, which last week disclosed that it had raised $230m through a recent sale of tokens.

The new blockchains have been heavily backed but are yet to prove themselves. The price of tokens on the Solana blockchain has more than quadrupled since the start of August as it has become the platform for the sale of new collections of NFTs such as the Degenerate Ape Academy. But a technical failure earlier this month meant the network suffered a 17-hour outage.

While Ethereum’s limitations have provided an opening for newer blockchains, the network’s supporters claim its early lead in smart contracts will be unassailable.

The hopes rest heavily on the large number of developers who are already creating applications using its technology. Solidity, the blockchain’s programming language, has become as much a part of life for crypto developers as javascript is among web developers, said Nailwal, the co-founder of Polygon.

To attract more developers, most of the new blockchains let them run their applications in “Ethereum virtual machines”, creating bridges back to the Ethereum blockchain and maintaining the demand for ETH to secure transactions in their applications.

Other mechanisms that are starting to bring relief from the transaction processing bottleneck include so-called “layer two” networks like Polygon. These run on top of Ethereum and take some of the strain, for instance acting as aggregators that process transactions on their own networks before batching them up and lodging them on the Ethereum blockchain in a single transaction.

According to supporters, today’s layer two networks contain the seeds of a wider technology industry that is starting to take shape, with Ethereum at its heart. “We believe it will be a multi-chain world — but on Ethereum,” said Nailwal.

“There should eventually be space for all applications,” said Dan Finlay at Metamask, which offers wallets on Ethereum and claims more than 10m users. But he added: “We’re still at a stage where a lot of scaling strategies are being tried at once. I don’t think any of them has been validated yet.”

Ethereum itself, meanwhile, has embarked on a series of changes to its own network. The planned shift to proof of stake has become the biggest technical hurdle but is only one step in a series that could take years to play out.

Another involves “sharding” the network — splintering it into 64 separate but linked ledgers, reducing the strain on each node in the network by no longer requiring it to validate every transaction. Buterin says he is also working on other changes to the underlying protocol to reduce the load on nodes and says he is optimistic that within two years some of these initiatives will have greatly increased capacity.

“The success of the currency will rely on Ethereum opening up more,” said Jack O’Holleran, CEO of Skale, a network that operates on top of Ethereum. “It will become the global settlement layer” for decentralized applications of all kinds, he and others predict.

But with Ethereum’s long-term role still a matter of debate, investors like Garg warn, the cryptocurrency markets could be overdue for a reversal that will see Bitcoin vault back to unquestioned dominance.

Source: https://www.ft.com/content/b1ff8c39-a047-46ac-8df1-650265842c63