Binance’s market dominance fell largely due to its decision to end zero-fee trading for some trading pairs and not the CFTCs lawsuit, says Kaiko.

The dominance of cryptocurrency exchange Binance in trading volume market share has slipped over the past two weeks following a lawsuit from the United States commodities regulator and its decision to halt some zero-fee trading.

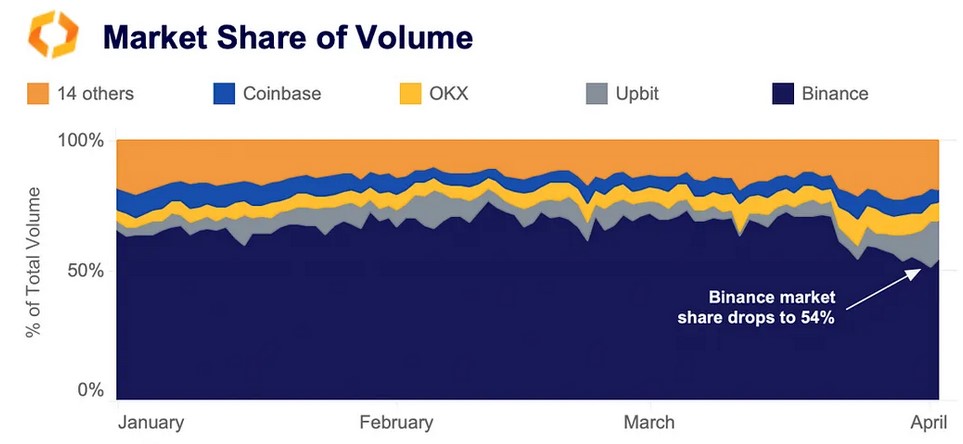

In an April 4 newsletter blockchain analytics platform Kaiko reported Binance “lost 16% market share of trade volume,” with its market share at 54% as of the end of Q1.

The U.S. Commodity Futures Trading Commission (CFTC) sued Binance on March 27 alleging it flouted regulatory compliance through violations of derivatives laws by offering trading to U.S. customers without registering.

Kaiko said Binance still takes in more volume than the rest of its combined competitors but its March 15 decision to end zero-fee spot and margin trading for 13 trading pairs including BNB, Bitcoin and Ether trading pairs with multiple fiat currencies and stablecoins largely contributed to the firm’s downfall.

“Overall, Binance’s excess volume largely vanished with the end of zero-fee trading, which was reflected in an even dispersal in market share among the remaining exchanges,” Kaiko reported.

Kaiko explained part of this fall was alleviated by its U.S. arm, Binance.US, which managed to triple its market share over the quarter from 8% to 24%.

Binance didn’t fall excessively in every domain though, the exchange managed to maintain its derivatives dominance, only giving up 2% market share over the last quarter.

Kaiko explained that the fall in trading volume figures was influenced mostly by the end of zero-fee spot trading as opposed to the CFTC lawsuit:

“The trend is quite different when looking at derivatives volumes: Binance only lost about 2% of market share for perpetual futures trade volume. This suggests that the majority of market share was lost purely due to the end of zero-fee spot trading, rather than trepidations around a lawsuit.”

The market share fall to 54% comes as Binance was one of the “big winners” of the FTX fiasco which saw its market share in trading volume rise to 65% during the last quarter of 2022:

“Binance’s market share increased from 50% to 65% after November 2022, while OKX saw its market share increase from under 10% to 17%. Bybit and the three smaller exchanges Huobi, Bitmex and Deribit, on the other hand, saw their market share decline.”

Over the last quarter, Upbit was the only crypto exchange to reclaim a “significant share” in trading volume of the 17 trading platforms that Kaiko analyzed.

In light of recent regulatory pressures, the banking crises and the catastrophic collapse of FTX, many reports have observed a growing trend towards decentralized alternatives and self-custody wallets.

Bitcoin and Ether left centralized exchanges in record numbers following the fall of FTX. The daily trading volume of decentralized perpetual exchanges also reached $5 billion in November 2022, the most since Terra Luna Classic (LUNC) and its connected TerraClassicUSD (USTC) stablecoin collapsed in May 2022.

Trading volumes on the decentralized exchange Uniswap are now rivaling that of crypto exchanges Coinbase and OKX but is still only a fraction of the size processed by Binance.