The SLRV Ribbons and Bitcoin Yardstick tools both reveal copycat behavior from 2019 when it comes to Bitcoin price recovery.

Bitcoin is on the road to a new bull market and should deliver serious returns in the process, fresh analysis reveals.

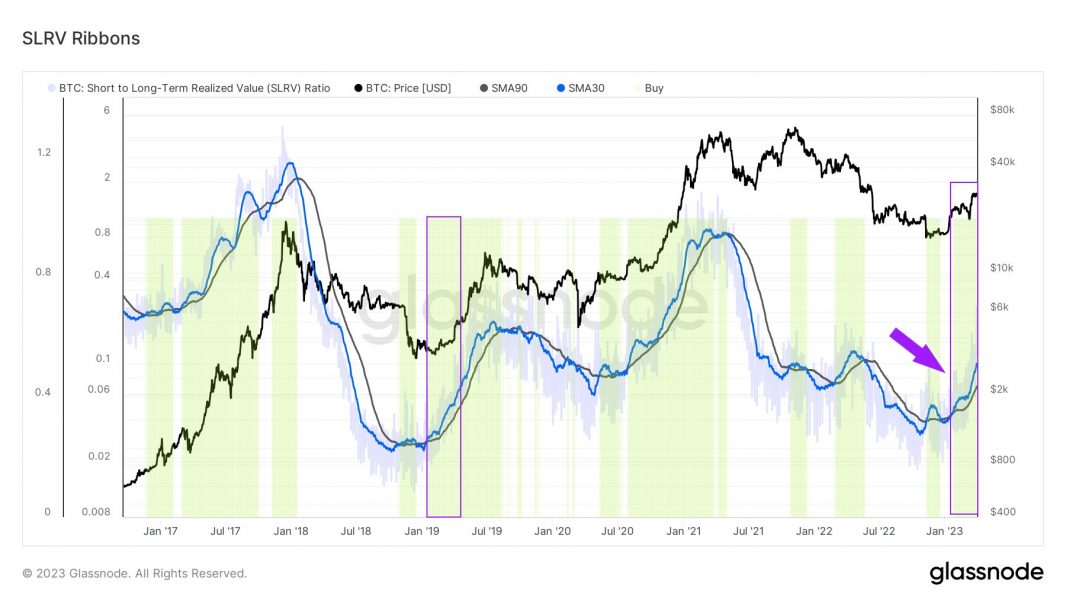

In a tweet on April 2, Charles Edwards, founder of Bitcoin and digital asset hedge fund Capriole Investments, flagged a “familiar” bull signal on the SLRV Ribbons metric.

Edwards: SLRV beginning “new trend”

SLRV Ribbons is a tool for measuring potential Bitcoin profitability. Put forward by Capriole in 2022, it is based on the Short-to-Long-term Realized Value (SLRV) Ratio from well-known analyst David Puell.

The SLRV Ratio takes the percentage of the BTC supply active in the last 24 hours and compares it to that last active six to 12 months ago. The result shows how comparatively active short-term supply and long-term supply are at a given point.

From this, an investor can gain an insight into both sentiment and likely price trajectory, but over time, such supply values may change, Edwards argues.

SLRV Ribbons attempts to address this by analyzing the interplay between two moving averages. When its short-term 30-day MA crosses over the long-term 150-day MA, Bitcoin is at the start of a bullish phase.

The metric “is about as simple as gets” when it comes to reliable Bitcoin analytics tools, Edwards explained in an introductory blog post, and is currently repeating classic bullish behavior with a crossover taking place in early 2023.

“A new trend in SLRV ribbons, and it looks familiar,” he summarized.

While relatively new, Edwards added that SLRV Ribbons had been backtested to show both its reliability and capability to improve BTC investment returns versus buying and holding.

Bitcoin is still “cheap”

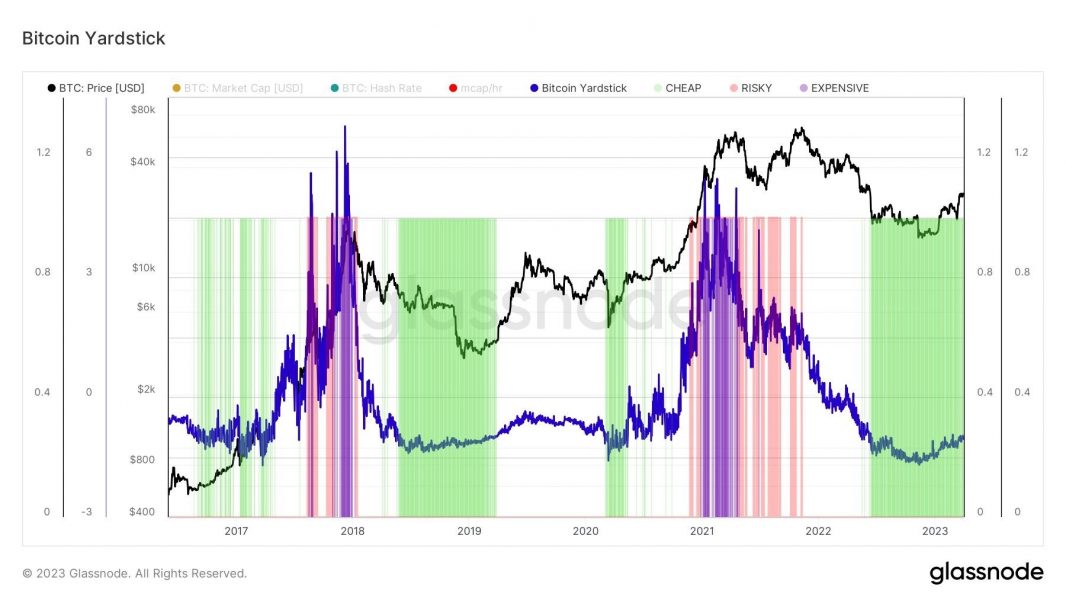

SLRV is not the only Bitcoin metric giving Edwards a sense of deja vu this month.

The Bitcoin Yardstick, previously covered by Cointelegraph, reveals a recovery in Bitcoin market cap versus hash rate but still classifies BTC as “cheap” at current prices.

“The Bitcoin Yardstick is painting a very familiar signature to the 2019 lows,” Edwards commented on March 31.

After exiting the “cheap” zone early that year, BTC/USD then only saw one brief return during the March 2020 COVID-19 cross-market crash.

Source: https://cointelegraph.com/news/bitcoin-copying-familiar-price-trend-in-2023-two-more-metrics-show