Bitcoin should break new all-time highs in 2024 — but the halving will punish bulls first, new analysis says.

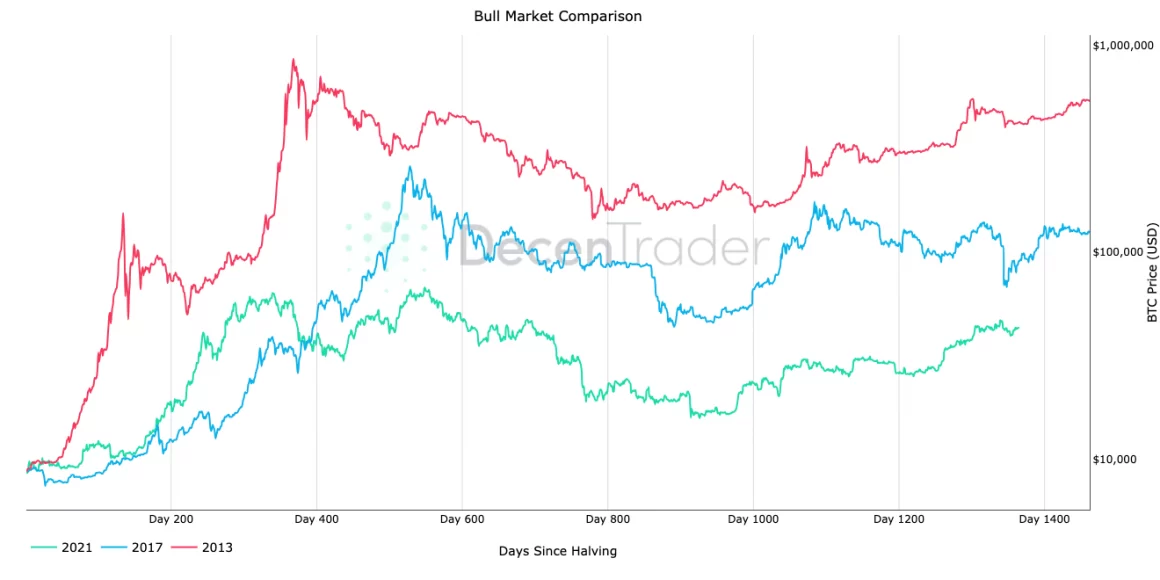

In its latest market update released on Feb. 2, trading suite DecenTrader predicted classic “halving year” BTC price behavior.

DecenTrader: Bitcoin will “test investors’ resolve” before Q4 all-time high

Bitcoin has around one month of sideways price action before markets begin to react to the upcoming block subsidy halving, DecenTrader believes.

Summarizing the BTC price roadmap for this year, CEO and co-founder Filbfilb told readers to expect a spike in buying around two months before the halving date, currently estimated for April 18.

This will be followed by another “sell the news event” — similar to the events surrounding the launch of spot Bitcoin exchange-traded funds (ETFs) in January.

“Circa 75 days remain until the Bitcoin halving, with it due to occur around the 18th April 2024. This is important if we make a simple assumption, that there will be buying interest some time before the halving. I would expect this to be no later than 6 weeks before the halving – or around the second week of March,” Filbfilb wrote.

“This would mean that Bitcoin has around 30 days from now to meander through its corrective phase before finding the FOMO demand anticipated.”

Anticipation among speculators could take BTC/USD to its current two-year highs of $49,000 before an ETF copycat sell-off ensues.

Thereafter, however, the path opens up to price discovery hitting before 2024 is over — a phenomenon seen during Bitcoin’s last halving year in 2020.

“Bitcoin has a tendency to front run the sell-the-news with a halving so bear that in mind,” Filbfilb continued.

“Following the Halving, Bitcoin has taken 220 – 240 days to break to new all time highs. I am expecting a similar outlook, with Bitcoin taking a trip to new all time highs in mid to late Q4 of 2024, which give some time for a correction to test investor’s revsolve inbetween.”

Bitcoin halving: Not different this time?

The timing of the coming months’ BTC price fluctuations makes Q1 difficult to navigate for traders.

As Cointelegraph reported, beyond Bitcoin-specific factors, macroeconomic and geopolitical hurdles are lining up to cause wider risk-asset turbulence.

These include United States banking system weakness — something which Arthur Hayes, former CEO of crypto exchange BitMEX, sees coming to a head in March.

Others believe a new all-time high for BTC/USD will not come until the end of 2025.

For Filbfilb, there is little reason to be overly optimistic on what the coming weeks will bring.

“What has become apparent is that a lot of people are convincing themselves that Bitcoin is going to run to new all time highs ahead of the Halving because ‘it’s different this time,’” he explained.

“I personally expect it to be no different to previous instances; there is an uncannily accurate market cycle schematic for Bitcoin born out of the emotions of investors into an asset class to which many are emotionally attached – it seems unwise to expect this to break (favorably) now.”

Source: https://cointelegraph.com/news/bitcoin-sell-the-news-before-2024-btc-price-all-time-high