As the Turkish lira has been losing its power, citizens have been turning to crypto. While Turkey’s annual inflation rate has reached 78.62%, the BTC volume of local P2P trading has increased significantly in Q1 and Q2 2022, compared to Q4 2021.

According to data from the Turkish Statistical Institute, Turkey’s inflation rate has hit its highest level in 24 years — the annual inflation rate of 78.62%, with a monthly increase of 4.95%.

Among the reasons why the inflation rate has risen to such an astronomical level are the increasing cost of energy and the weakening Turkish lira. Other countries have also faced inflation rate spikes, pushing the European Central Bank to increase the interest rate first in 11 years.

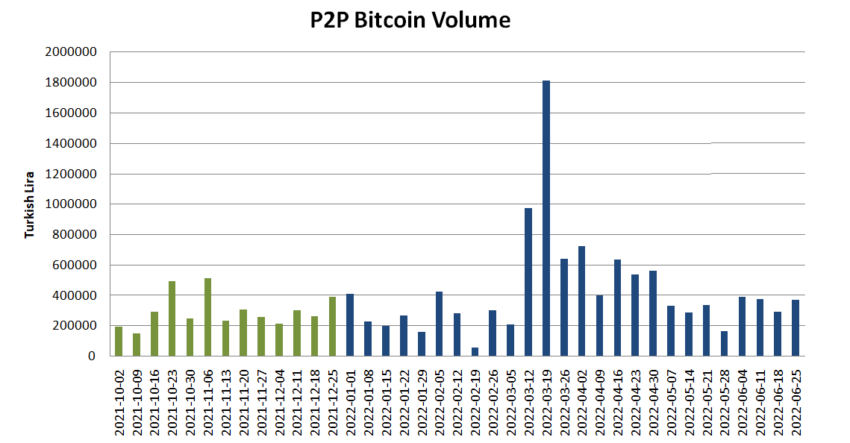

Notably, as the lira has been weakening, the amount of BTC volume of P2P trading on LocalBitcoins in the region has been growing considerably. BTC peer-to-peer trading volumes in the first quarter and second quarter of 2022 have seen massive increases compared to the fourth quarter of 2021.

(Source: Bitcoin P2P volume: LocalBitcoins )

In Q1 2022, LocalBitcoins trading volume increased by 51% over Q4 2021, while Q2 2022 trading volume increased by 40%. These are substantial increases that indicate that the public is turning to cryptocurrency to protect their financial positions.

Amid the economic turmoil, the Turkish government is turning to various measures. However, all demographics are turning to crypto, and neither age nor gender affects the decision to invest in crypto.

As President of Turkey Recep Tayyip Erdoğan has made his dislike for raising interest rates known, calling interest rates the mother of all evil, this has led to the decline of the Turkish lira, and the country may have to take drastic measures to contend with the issue.

To combat inflation, the government has revealed a scheme that will bring gold savings at home into the banking system. The gold conversion deposit account will offer risk-free incomes, the government says. It estimates that there is approximately $250 to $350 billion in gold in homes.

In 2021, Turkey barred crypto payments, but that does not seem to have stopped citizens from investing in it purely as an asset class. Should the struggle continue, it will only be more likely that crypto investments grow. Individuals have often turned to crypto as a hedge against inflation, though that argument seems to be losing its strength.

Last September, the Turkish President commented during a national youth meeting with representatives from Turkish provinces:

“We are in a war against Bitcoin,” he said, following questions about the central bank’s perceptions of cryptocurrencies. “Because we will continue on the road with our money, which is our fundamental identity in this matter.”

This January, as inflation in Turkey rose to 36% and the country’s currency lost 44% against the US dollar, the use of stablecoins in Turkey skyrocketed, with 28.96% of all trades with Tether (USDT) paired against the Turkish lira.