The Starknet Alpha project has transitioned from several months of operation on the public testnet to the Ethereum mainnet, exceeding the initial schedule. The development progressed successfully during its time on the testnet, with regular updates introducing new features. Starknet Alpha is a Layer-2 scaling solution for Ethereum, built on ZK-Rollup technology. This technology leverages proofs of authenticity to scale computations, performing computations off-chain and sending proof of authenticity back to the mainnet.

Similar to other Layer-2 rollup-based solutions, the Starknet blockchain aggregates a large number of transactions into rollups, and using cryptography, verifies their authenticity. What sets Starknet apart from its competitors is the use of its own zero-knowledge proof mechanism, zkSTARK.

Starknet employs the most secure and scalable proof system, zkSTARK, which stands for Zero-Knowledge Scalable Transparent Arguments of Knowledge—a succinct transparent argument with zero disclosure. The creator of zkSTARK technology claims that, in theory, it can consolidate up to 60 million transactions in a single block on the Ethereum blockchain.

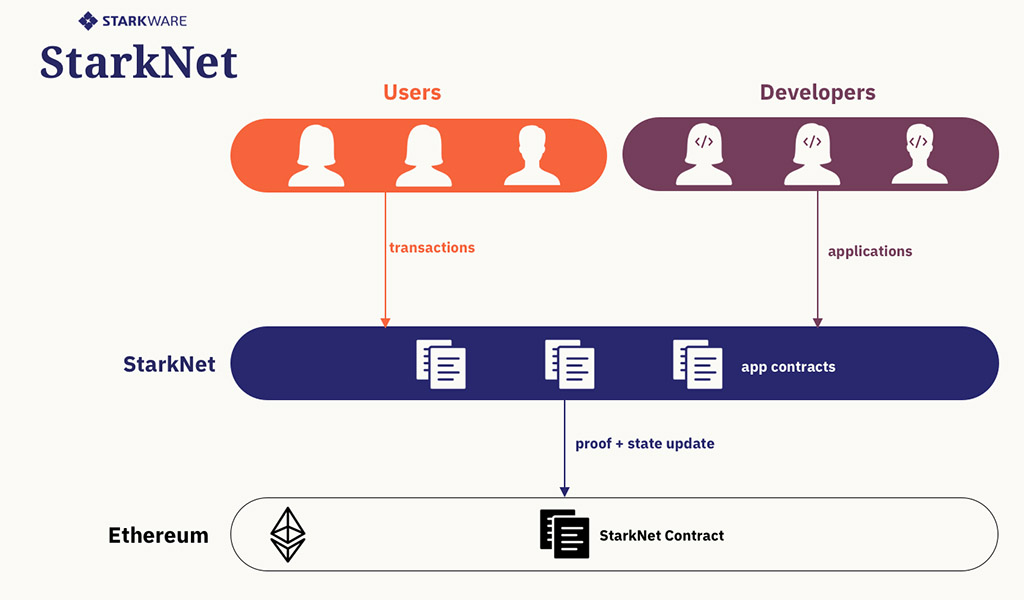

The Starknet network structure comprises three types of nodes located outside the Ethereum blockchain:

– Sequencer: This node receives transactions, verifies them, and combines them into rollups.

– Prover: Responsible for creating proofs that confirm the integrity of computations performed by the sequencer.

– Full State Node: Used solely to query the current state of Starknet, it can independently respond to requests about the current state of the Starknet network, including the state of the parent Ethereum blockchain. It does not group transactions or confirm packages.

There are also two on-chain components within Starknet that reside on the Ethereum network:

– Verifier: A smart contract on the Ethereum network that receives generated proofs from Prover nodes, verifies them, and sends data to Starknet Core.

– Starknet Core: Another smart contract on the Ethereum network that receives changes to the global state of Starknet when a new block is successfully created and verified on the second layer.

This Starknet architecture enables a significant reduction in transaction costs, up to 100-200 times less than the Ethereum blockchain. This reduction aligns with the primary goal of Layer-2 solutions. Consequently, Starknet allows any decentralized application (dApp) to achieve unlimited scalability for its computations without compromising composability and the security of the Ethereum network.

So, who developed this architecture? Meet StarkWare Industries, an Israeli company founded in 2017. Focused on security, reliability, and high scalability, StarkWare’s project boasts notable founders such as Eli Ben-Sasson, a renowned cryptographer and professor at Technion University, who is also a co-author of STARK technology and was involved in creating the anonymous cryptocurrency Zcash. Other co-founders include Mikhail Ryabtsev (co-author of ZK-STARK), Uri Kolodny, and Alessandro Chiesa (co-founder of Zcash), all widely recognized specialists in the crypto community.

Starknet is built using the Cairo programming language, the first complete Turing verifier on Ethereum, following the von Neumann architecture. Both Cairo and STARK were developed by StarkWare and are used in industrial-level applications. In addition to other features, Starknet Alpha provides smart contracts for general-purpose computations, supporting composability with other Starknet contracts and L1 <> L2 message exchange with L1 contracts.

The Starknet project roadmap was published in January 2021, and in June, Starknet Alpha was launched on the public testnet, continuously evolving with new features. The development team managed to surpass the schedule by using the proven and reliable STARK/Cairo software stack.

It’s important to note that Starknet Alpha is still an experimental project and has not undergone an audit. The project developers are taking a cautious approach, launching the network with a single sequencer and gradually adding applications to a whitelist. The principle of full decentralization remains fundamental to Starknet.

The launch of Starknet Alpha on the Ethereum mainnet is an invitation to independent developers to start building their own applications on Starknet. Interested developers can register and explore the project’s documentation for guidance.

During the testing phase, the Starknet community, united on Starknet Discord, experienced significant growth, including dozens of developers, both as teams and individual specialists. Developers have access to various tools and infrastructure elements, including wallets, key management solutions, audits, and API services.

The creators of Starknet have ambitious plans for the future. In the near term, the alpha version of the project will gain capabilities such as

- contract updating

- fee mechanisms

- events

- some missing system call

- a skeletal version of Volition

- and more…

The strategic directions for the project’s development include decentralization, scalability, data availability, and an independent reward system.