Bitcoin has proven to be resilient even against such a strong shock as mining restrictions in China. Regions that offer the necessary infrastructure and easy regulations for transferring miners will gain the biggest benefit.

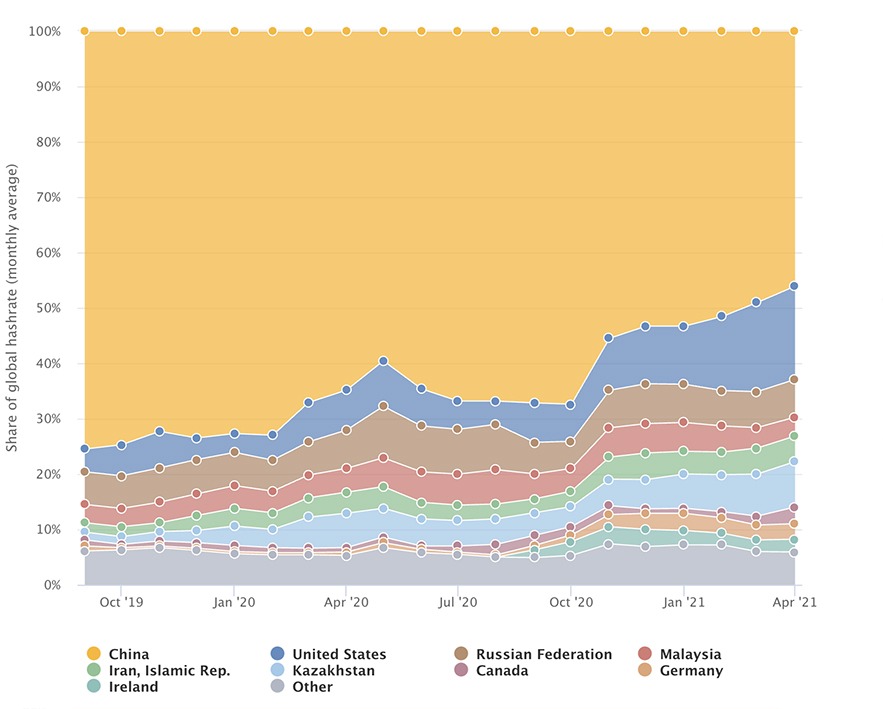

The Cambridge Centre for Alternative Finance, a creator of the Cambridge Bitcoin Electricity Consumption Index (CBECI), estimates that China shared 46% of all Bitcoin mining in April, down from 75% in September 2019. Although, given the latest crackdown, we can assume that China’s current share is actually much smaller than 46%.

According to industry participants, crypto mining has relocated mostly to Central Asia, Eastern Europe and North America, while the end of Chinese mining dominance will likely have a positive effect on Bitcoin’s decentralization.

The expert opinion leaves vague hope that mining might come back in China later.

Juri Bulovic, the Vice President of strategy at US-based mining specialist Foundry, suggested that the ban could be related to CCP’s 100th anniversary and their desire to portray strength and authority in all aspects.

“If that’s the case, it is possible that we will see mining restrictions loosen up in the coming years,” he said.

However, Nishant Sharma, the founder of mining consultancy BlocksBridge, isn’t so optimistic.

“China’s crackdown on mining is mainly a result of President Xi’s ambitious climate goals and, to a lesser extent, mining’s potential impact on financial and social stability, which the central government places a very high importance on. Thus, I believe that the crackdowns are here to stay and that there will be more crackdowns targeting the remaining large-scale mining operations in other parts of the country,” he said.

For now, Bitcoin’s steep hashrate drop since June reveals that a huge part of Chinese miners have gone offline.

According to Kevin Zhang, Foundry’s Vice President of business development, much of the share of crypto mining has now transferred mostly to three regions, such as Central Asia, Eastern Europe, and North America.

Zhang added that areas that offer the necessary infrastructure and don’t put too many regulatory obstacles in the way of incoming miners will gain the biggest benefit.

This argument is corresponding with the CBECI data updated on July 15. Kazakhstan has up its share of global Bitcoin mining from 1.4% in September 2019 to 8.2% in April 2021. Other beneficiaries include the United States (4.1% to 16.8%) and Russia (5.9% to 6.8%). Also, both Canada and Germany have seen increases from 1.1% to 3% and from 0.9% to 2.8%, respectively.

“But more generally, we think that all regions globally are benefiting from the migrations, including North America, South America, Europe, and Australia,” said Bulovic.

(Source: jbs.cam.ac.uk)

According to Igor Runets, the founder/CEO of mining colocation services provider BitRiver, the longer-term effect is likely to be positive, even if the Bitcoin network suffered a marked decline in its hashrate.

“This relocation is only good for Bitcoin in the near and longer-term as Bitcoin mining becomes more geographically decentralized around the world, improving Bitcoin’s value proposition as a reliable store of value and increasing the confidence of investors and governments in Bitcoin. Furthermore, this would make mining more institutionalized and transparent as it moves from the hands of private and secretive companies or investors in China to more transparent, and sometimes even publicly traded, companies around the world,” he said.

Juri Bulovic also suggested that Bitcoin’s continued reliability in the face of mass miner shutdowns is a sign of its strength and robustness.

“In the grand scheme Bitcoin is not affected. The Bitcoin network has proven to be resilient, even against such a strong shock as this ban was,” he said.

That said, even if Bulovic acknowledges that a move away from China may be positive as far as decentralization is concerned, he highlighted the possibility that mining may consolidate around another part of the world in the not-too-distant future.

He said, “North America’s Bitcoin mining industry is growing at a rapid pace, and I wouldn’t be surprised if, in a couple of years, we are discussing how Bitcoin mining is heavily concentrated in North America.”

As reported before, mining becomes more profitable worldwide, as China’s crypto crackdown led to a significant Bitcoin hash rate drop.