Main attraction lies in turning the funds into tradable tokens, write ByOlga Kharif and Vildana Hajric on Bloomberg. However, DAO hacks remain a common threat, while legal protection is limited.

Index funds have long been pitched as a low-risk and inexpensive way to invest. Now they’re coming to the rollicking world of cryptocurrencies, but with plenty of caveats as well as expectations for eye-popping returns.

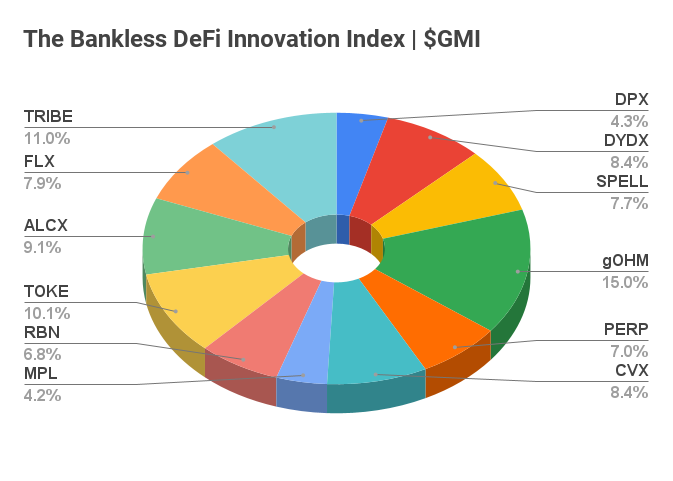

In a nod to the decentralized aspirations of crypto, the handful of funds offered — which go by names such as Index Coop, Indexed Finance, PieDAO, and BasketDAO — are run by DAOs, the decentralized autonomous organizations that are governed by software programs and user communities.

Over the past year, these community-run index funds have raised hundreds of millions. Launched about a year ago, Index Coop — likely the biggest — manages about $343.5 million for more than 26,000 users, said Simon Judd, head of business development. Synthetix, which offers a slew of non-index products as well as a decentralize finance, or DeFi-tracking index, has about $386 million in assets. Indexed Finance has nearly $11 million.

“I see this as a maturing of the overall crypto ecosystem,” said Bennett Adams, a New Yorker who said he invested about $50,000 into Index Coop. “The to-the-moon swings are fun, but that’s not a retirement strategy. What Index is building is going to work for a long-term hold.”

The index DAOs are still relatively small, compared with around $2.2 billion invested in crypto index funds, according to a tally kept by James Seyffart at Bloomberg Intelligence.

The main attraction lies in turning index funds into tokens that people can trade, lend out and borrow to increase returns. Take Index Coop, which issues seven fund tokens, each focused on sectors such as DeFi or metaverse, and also lets people invest with leverage. Users can lend their tokens through DeFi projects such as Aave and earn returns. Or they can convert a fund token into its underlying tokens, such as converting DeFi Pulse Index token, or DPI, into tokens of Aave, Uniswap and Compound. The tokens trade on decentralized exchanges.

The index DAOs are still relatively small, compared with around $2.2 billion invested in crypto index funds, according to a tally kept by James Seyffart at Bloomberg Intelligence.

The main attraction lies in turning index funds into tokens that people can trade, lend out and borrow to increase returns. Take Index Coop, which issues seven fund tokens, each focused on sectors such as DeFi or metaverse, and also lets people invest with leverage. Users can lend their tokens through DeFi projects such as Aave and earn returns. Or they can convert a fund token into its underlying tokens, such as converting DeFi Pulse Index token, or DPI, into tokens of Aave, Uniswap and Compound. The tokens trade on decentralized exchanges.

“Imagine being able to take a share of SPY (SPDR S&P 500 ETF) and redeem it for the underlying S&P 500 companies,” said Mike Taormina, who invests into Index Coop’s DeFi Pulse Index fund. Taormina worked at JPMorgan Chase & Co. before becoming one of five full-time contributors at Index Coop.

While only accredited investors can invest directly into many centralized crypto index funds, index DAOs are usually open to anyone. Much of a DAO’s financial activity is also registered on the blockchain — often, Ethereum — for anyone to see.

Another benefit comes from being able to impact the index DAO’s activities via related governance tokens. Index Coop, for instance, issues Index, which has been purchased by some large venture-capital investors. On Dec. 8, Sequoia Capital India invested $2.25 million, following in the footsteps of investors like Mike Novogratz’s Galaxy Digital. The token can not only be used for voting on Coop’s future products and strategic direction, but also on all of the projects it invests in. So an investor with Index tokens can have a say in future development of Aave or Compound, for instance.

“The positive aspect of investing through a DAO is you, as an average retail user, get to have more say in the products that come out,” said Hany Rashwan, co-founder and CEO of 21Shares, a provider of crypto exchange-traded products. “You and I, if we owned an index token could go and suggest an index of the metaverse to be created and maybe even have opinions of what should be in it; and if we can convince enough of the people, we can move forward and force the organization to do this.”

Returns of index DAOs vary. DPI’s price has more than doubled since the beginning of the year, though it’s down significantly from its May all-time high, according to data tracker CoinMarketCap.com. Its Metaverse Index, which includes tokens for popular projects such as Axie Infinity and Rarible, has more than doubled since the beginning of the year. Over the same time, Bitcoin is up about 60%, while Ether rose more than fivefold.

The index DAOs’ fees can be higher or lower than those for traditional exchange-traded funds, which take a 0.5% fee for passive investments on average. Indexed Finance said it doesn’t collect a management fee. Most users, who simply buy, hold and trade the index tokens don’t pay any fees, though there are fees for swapping assets within index pools and when users want to turn their index tokens into their underlying components.

But Index Coop takes about 1% for minting, or issuing a new fund coin, and a similar redeem fee if users exchange the fund token for underlying assets. There’s also a streaming fee for when the fund mints additional tokens that flow into the treasury.

“The returns are going to be better with these products because it’s DeFi,” said Les Borsai, co-founder and chief strategy officer of Los Angeles-based Wave Financial Group. “They’re taking aggressive returns.”

DAOs have focused on investing from their very beginning. One of the first DAOs created on Ethereum in 2016 and called the DAO, was supposed to invest in crypto startups. It famously got hacked, and Ethereum had to undergo a software upgrade to stop thieves from making away with some $50 million of the funds. Today, PleasrDAO is a community of users acquiring digital artwork. ConstitutionDAO attempted to buy a copy of the U.S. Constitution. Today, DAOs of all kinds hold about $10.7 billion in funds, according to tracker DeepDAO.

Hacking risks remain, and a DAO is hacked almost weekly. Also, “with DAOs, there’s obviously risk in terms of code, there’s a risk of disproportionate ownership by core people,” said John Wu, president of Ava Labs. “These risk things are coded — intentionally or unintentionally — poorly.”

The DAOs’ unusual structure — often with no centralized legal entity with a given address — also carries risks for the end users.

“The drawbacks associated with it is you absolutely have zero legal protections on anything,” Rashwan said. “DAOs are run by people. Those people can be well-intentioned, they can also be thieves.”