The story of the Squid cryptocurrency scam has once again drawn attention to the issue of so-called “meme” cryptocurrencies. What are they – a malevolent outgrowth compromising the entire cryptocurrency industry or an incomprehensible phenomenon at the intersection of technology and sociology that deserves to be studied?

Feels like 25-30% of all news on cryptocurrency topics this year were somehow related to meme currencies. Hundreds of millions of people have heard about Shiba Inu, Doge, Floki Inu, and even other less-known projects. And this despite them not having an extensive background like Bitcoin, or modern developments and a strong team like, for example, Solana.

Moreover, although these currencies, by and large, don’t offer any breakthrough technological or economic solutions, they still contend for some important role in the “new economy”.

Here’s an example: a giant SHIB video ad was displayed in the most visited place in New York.

SHIB isn’t the only cryptocurrency to rent out a screen in Times Square. At the height of their popularity, Dogecoin and Safemoon were also advertised in the legendary pedestrian zone. An ad like this on a busy tourist route can cost up to $ 50,000 a day.

Not to get outdone, the Floki Inu token named after Elon Musk’s dog launched its advertising campaign in the London public transport system. Ads with the slogan “Missed Doge? Get Floki” could be seen on London Underground stations, trains, and buses.

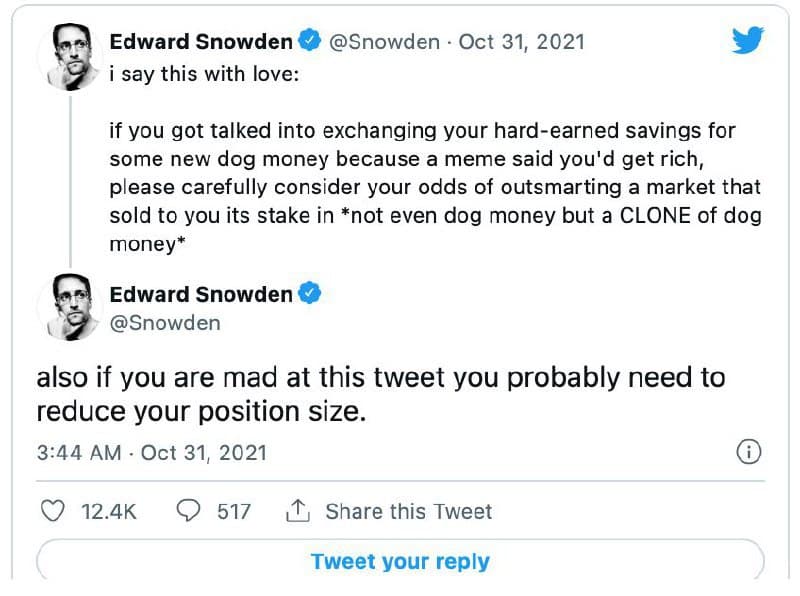

The famous ex-CIA and NSA officer Edward Snowden has recently advised his Twitter followers not to invest in “dog currencies”. In his opinion, the chances of outperforming the market and getting rich on them are exceedingly small. Snowden urged everyone invested in meme currencies to short their positions.

“Please carefully consider your odds of outsmarting a market that sold to you its stake in *not even dog money but a CLONE of dog money*”, – he wrote. Snowden said he doesn’t care about people just buying “trash”. But he is worried about those who decide to “bet the farm” to get SHIB hoping for a quick profit.

However, such admonitions, including from experienced crypto specialists, have little effect. Cryptocurrency chats are full of discussions about how Shiba Inu or Doge will trade the next day, whether it is time to sell PORTO and if it is still worth holding DAR.

And although it is clear that another big “hamster haircut” is not far away, the meme cryptocurrency market is currently amassing vast amounts of investment. Tokens based on some kind of cultural phenomenon – an Internet meme, as in the case of the Shiba Inu cryptocurrency, or a TV series, as in the case of Squid – soar in price for no particular reason, other than good advertising.

The explanation is simple: over the past couple of years, lots of young people have joined the crypto community. Many of them hardly even had a notion of crypto in the winter of 2017-2018, during the first large-scale hype and an equally massive collapse that followed.

New “crypto bros” are people who got some disposable income due to large-scale government injections into the economy as part of corona crisis recovery legislation, that is, in 2020-2021. They are retail investors who still view cryptocurrencies solely as a tool for generating money out of thin air. Subsequently, they have no desire to in any way delve into the technical features of different coins, the scope of their application, and the intrinsic value behind their market cost. They, by and large, do not need it, seeing a giant market for meme cryptocurrencies like Dogecoin and Shiba Inu, where rates go up and down in a matter of hours, massively profiting their holders.

As a result, newcomers perceive the cryptocurrency market more as a kind of gamble than as a fundamentally new financial system. They are looking for hype, not some tech platform. Which, among other things, explains the story with Squid Game-based token.

No sooner had the Squid scam wrapped up than another hyped-up topic took its place. All thanks to Mark Zuckerberg’s new metaverse, the main topic of conversation over recent months. It obviously caused a reaction in the crypto community: after token sales, all metaverse-related projects have been receiving 195 times more investment.

Two foundations for the development of the metaverses were created in November alone. The trend is supported not only by crypto startups but also by large companies. Following Meta (former Facebook), Nike, Tencent, Nvidia, Microsoft, Epic Games have already begun to move towards creating their own virtual worlds. Even Binance has tweeted hints indicating metaverse development.

Unsurprisingly, there is already a special launchpad for metaverse projects called PlayPad. So look forward to a new wave of hype crypto projects with the word “META” in “white papers”, but without any serious technological or economic model behind them. Fingers crossed, there won’t be many scam projects among them.