The crypto exchange created a new product, “Nitro Spreads,” to provide institutional investors with an easier way to “trade the basis” and successfully navigate the market.

In the highly volatile and ever-changing cryptocurrency market, exchanges are striving to not only survive but thrive in all market conditions. They understand the importance of catering to institutional investors who demand innovative tools and solutions to meet their evolving needs.

A common trading strategy for institutional users is trading the basis, or taking advantage of the difference between an asset’s price on different markets, such as spot and futures.

Responding to the trading community’s needs, OKX has launched a product for institutional users to execute basis trades with one click.

In this interview, Lennix Lai, global chief commercial officer at OKX, highlights the challenges institutional traders are currently facing when trading cryptocurrencies, and discusses how OKX is addressing them by continuously evolving its institutional offering with products like Nitro Spreads.

Cointelegraph: What specific challenges are institutional traders facing now?

Lennix Lai: Institutional traders need to maximize capital efficiency, minimize third-party risk, find trusted and efficient custodians and avoid price slippage, all while trading effectively. In complex market conditions, these users need strategies that deliver good returns with the least amount of risk.

Q: How do crypto exchanges address these challenges?

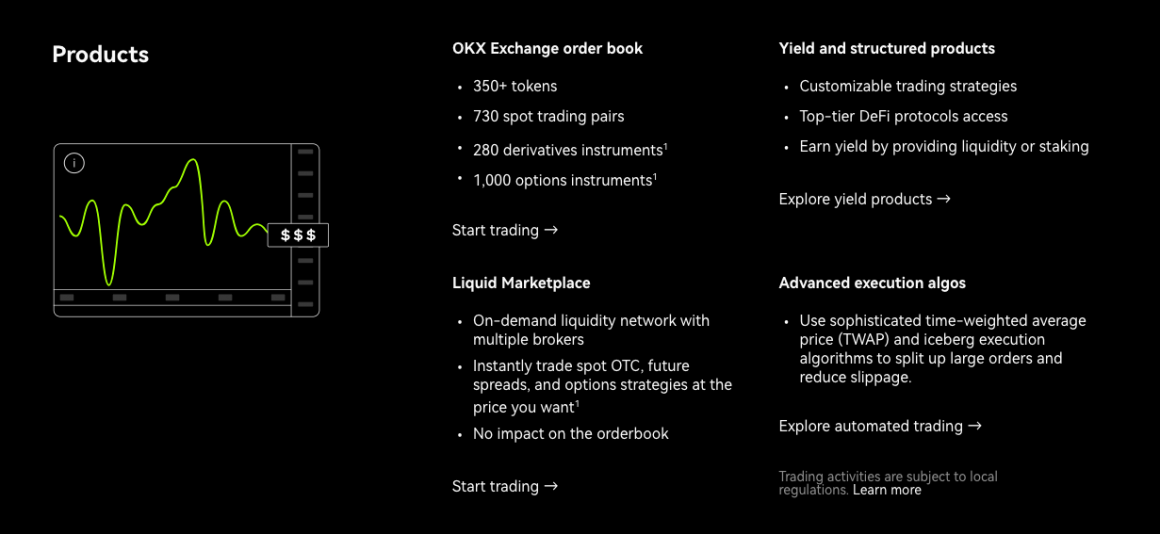

LL: As a crypto exchange, we listen to institutional users to develop new and improved ways to meet their needs. This can be through partnerships or products we develop, such as our new trading feature Nitro Spreads, designed for basis-trading strategies with dedicated order book liquidity.

Sophisticated crypto traders are not only astute market analysts, but they’re also proficient in evaluating crypto exchanges. Our institutional suite of products is constantly evolving to anticipate the needs of users to bring something the rest of the market has yet to offer.

CT: Can you explain the concept of basis trading?

LL: Basis trading is a strategy based on trading the difference between the price of an asset in two separate markets, such as spot and futures. It typically requires managing both legs of the trade simultaneously, which can be cumbersome. OKX’s Nitro Spreads automates this complex trade with a single click, leveraging the platform’s superior liquidity and low latency for maximum user value.

CT: What basis-trading strategies can institutional traders execute with OKX’s new Nitro Spreads product?

LL: Institutional traders can employ popular delta one spread strategies like calendar spreads, future rolls and funding rate farming — all in an order book format.

CT: How do Nitro Spreads simplify the process of basis trading for traders?

LL: Typically, spread trading requires traders to manually execute trades in two separate order books, creating leg risk. With Nitro Spreads on Liquid Marketplace, traders can now execute spread trades with a single click, ensuring “atomic” execution. This automated process reduces leg risk and takes advantage of the platform’s high liquidity and low latency.

CT: Are there any specific requirements for traders to access Nitro Spreads?

LL: OKX’s Liquid Marketplace and Nitro Spreads are currently only open to whitelisted institutional traders. To get access, traders need to fill out our application form.

CT: What risk management features are incorporated into Nitro Spreads to protect traders?

LL: In “atomic execution,” both legs of trade are executed together as a single unit. This means that the quantities traded for each leg are guaranteed to match, or the trade will not be settled at all. This approach helps mitigate the risks associated with price slippage and leg-in risk that can occur when legs are executed separately.

CT: What trends do you see for institutional participation in the cryptocurrency market?

LL: Institutional participation in the crypto market has been resilient in recent months, despite the hard times brought on by the collapse of FTX and the market downturn. To have long-term staying power in the crypto space, a company must survive and thrive in all market conditions. Many institutional firms are preparing for the cycles to come by fine-tuning their trading strategies and identifying trading venues that prioritize their needs.

We’re using this time to build our institutional offering here at OKX by expanding our trading capabilities and championing product innovation, such as our recent partnership with Komainu Connect. We stay ahead of the curve and anticipate the changing needs of our traders by staying connected to the trading community, with many of those at OKX driving product development also coming from a trading background.