Transactions on Optimism recently eclipsed the Arbitrum network, but do the project’s fundamentals support a sustainable growth trajectory?

Optimism is a layer-2 scaling solution that operates as a separate blockchain built on top of Ethereum. Despite having a smaller total value locked (TVL) than its rivals, Optimism may still have the potential to thrive in the increasingly competitive decentralized finance (DeFi) landscape.

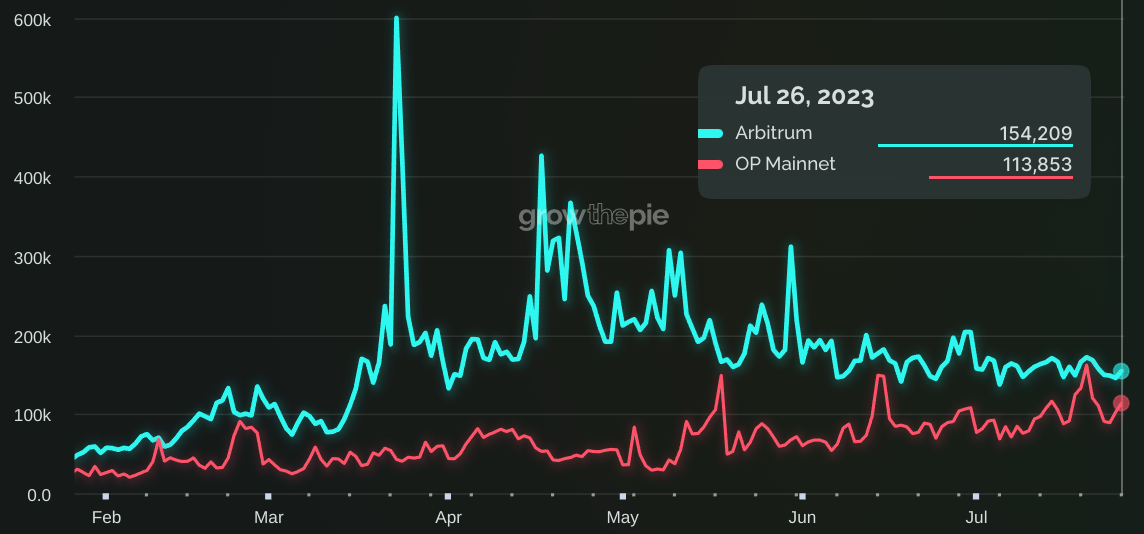

Being one of the pioneers in the DeFi space, Optimism initially gained an edge but had to contend with fierce competition. The project has been trailing behind other scaling solutions in terms of daily transactions for the past six months. However, in late July, the situation changed, as Optimism finally overtook its main competitor, Arbitrum, and is showing signs of increasing demand from users.

The rise of layer-2 scaling solutions

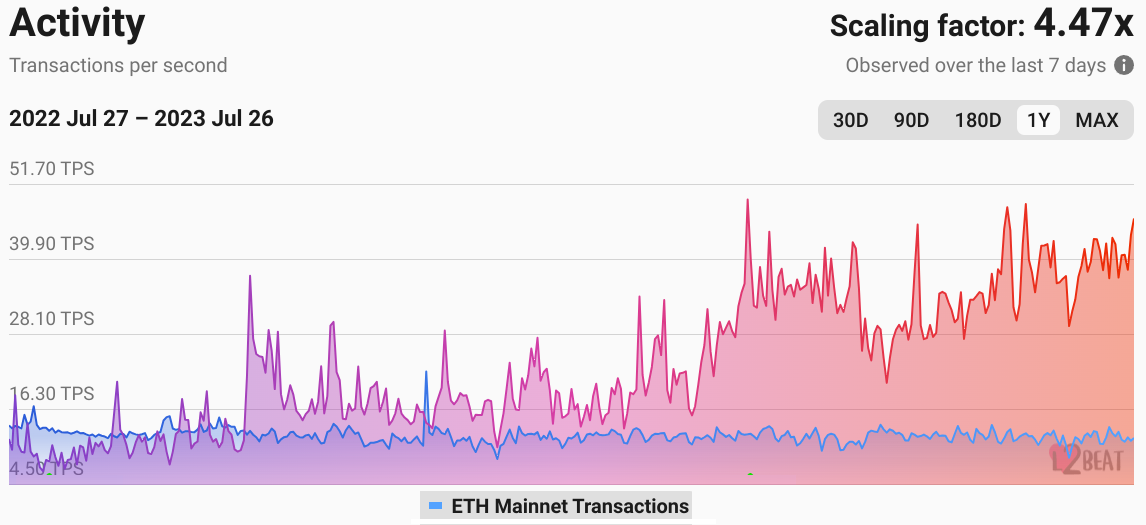

The increase in layer-2 activity on Ethereum has been significant, surpassing mainnet activity by more than four times, according to data from L2beat. Various solutions have emerged to address Ethereum’s scalability challenges, and each layer-2 project focuses on different aspects, such as privacy, specific decentralized applications and nonfungible token marketplaces.

Consequently, the leaderboard of transactions and volumes constantly fluctuates based on demand, and each solution comes with its own advantages and drawbacks.

Optimism operates using rollups, bundling transactions into a single transaction to be executed on the base layer, inheriting all security features from Ethereum. The philosophy behind Optimism assumes that all transactions are valid unless challenged and proven otherwise, allowing for cost-effective and fast transactions for users.

While Optimism and Arbitrum rely on rollups, the core difference lies in Arbitrum’s centralized approach, where a single entity (sequencer) is responsible for submitting fraud proofs. On Optimism, anyone can submit them.

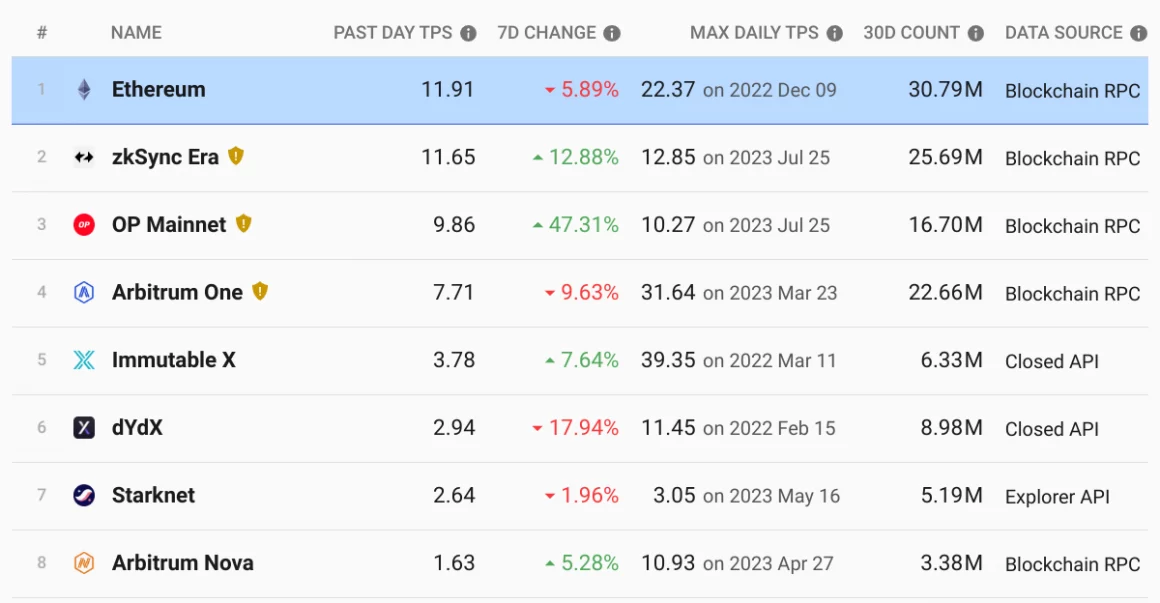

Among the layer-2 competitors, Optimism has been the standout performer since July 20, experiencing a 47% growth in daily transactions. This growth has enabled Optimism to surpass competitor Arbitrum in daily transactions for the first time in six months.

Furthermore, the Optimism protocol has witnessed a surge in daily active addresses, with a 27.6% increase in 30 days, while Arbitrum’s activity has declined by 7.5%.

This trend indicates a potential shift in dominance, although drawing conclusions prematurely would be unwise. Arbitrum’s main advantage lies in its much larger TVL compared to Optimism.

According to DefiLlama, Arbitrum currently holds a significant TVL of $2.35 billion, whereas Optimism’s TVL is comparatively lower at $920 million. Arbitrum’s dominance is especially evident in the DeFi applications it shares with Optimism, such as Uniswap and Aave. Additionally, Arbitrum boasts an impressive $500 million TVL in the derivatives exchange GMX.

Coinbase and Worldcoin back the recent surge in Optimism activity

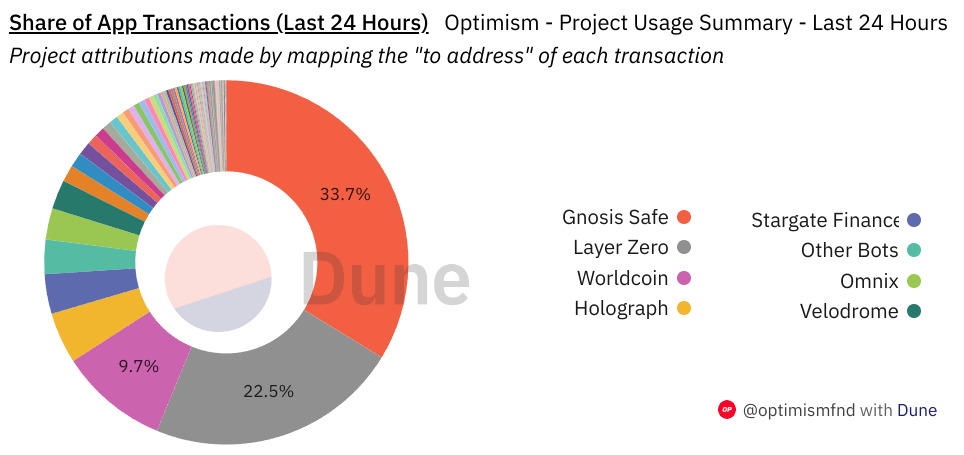

Two of the main reasons for higher demand on Optimism are increased use from Coinbase and Worldcoin (WLD). The project is also on track to implement important privacy mechanisms that could create another use case.

A pivotal moment for Optimism came with the launch of Coinbase’s sandbox on July 21, providing developers with a test environment to build and deploy new applications on this layer-2 solution. This initiative incentivizes the creation of new tools, applications and protocols, fostering growth and innovation.

One of the projects utilizing Optimism as a scaling solution is Worldcoin, which has been gaining substantial attention. The token airdrop on July 26 further boosted activity on Optimism after supporting Uniswap on the Optimism mainnet. Worldcoin has also deployed most of its Safe wallets on Optimism. This adoption has contributed significantly to the daily activity on the network, accounting for around 40%.

This trend indicates a potential shift in dominance, although drawing conclusions prematurely would be unwise. Arbitrum’s main advantage lies in its much larger TVL compared to Optimism.

According to DefiLlama, Arbitrum currently holds a significant TVL of $2.35 billion, whereas Optimism’s TVL is comparatively lower at $920 million. Arbitrum’s dominance is especially evident in the DeFi applications it shares with Optimism, such as Uniswap and Aave. Additionally, Arbitrum boasts an impressive $500 million TVL in the derivatives exchange GMX.

Coinbase and Worldcoin back the recent surge in Optimism activity

Two of the main reasons for higher demand on Optimism are increased use from Coinbase and Worldcoin (WLD). The project is also on track to implement important privacy mechanisms that could create another use case.

A pivotal moment for Optimism came with the launch of Coinbase’s sandbox on July 21, providing developers with a test environment to build and deploy new applications on this layer-2 solution. This initiative incentivizes the creation of new tools, applications and protocols, fostering growth and innovation.

One of the projects utilizing Optimism as a scaling solution is Worldcoin, which has been gaining substantial attention. The token airdrop on July 26 further boosted activity on Optimism after supporting Uniswap on the Optimism mainnet. Worldcoin has also deployed most of its Safe wallets on Optimism. This adoption has contributed significantly to the daily activity on the network, accounting for around 40%.